Ford and Geely are advancing discussions for Geely to use Ford’s underutilized European factories to produce EVs, potentially avoiding EU tariffs up to 37.6% on Chinese imports. This partnership could also involve sharing Geely’s advanced self-driving technology, helping Ford catch up in software-defined vehicles amid intensifying competition from Chinese brands. EV buyers in Europe stand to benefit from lower prices, while Ford secures factory utilization and tech access without massive R&D spend.

Background: Ford’s European Struggles Meet Geely’s Global Ambitions

Ford has faced mounting pressure in Europe, with high manufacturing costs and slowing EV demand leading to underused plants. The company reduced shifts at its Cologne, Germany, facility last month and has excess capacity at sites like Valencia, Spain and Saarlouis, Germany. CEO Jim Farley has openly called Chinese EV makers an “existential threat,” prompting partnerships like the recent Renault deal for affordable EVs.

Geely, owner of Volvo (acquired from Ford in 2010 for $1.3 billion), has grown into a powerhouse, selling 4.1 million units last year at 25% growth. Through brands like Zeekr and Lynk & Co, Geely leads in software-defined EVs. Existing collaborations include running the Smart brand with Mercedes-Benz and projects with Renault. This Ford talks mark Geely’s push into Europe to sidestep tariffs—18.8% provisional plus 10% standard duties on Chinese EVs.

Reuters reports, cited across sources, detail meetings in Michigan last week and a Ford team in China this week. Talks have simmered for months, focusing first on manufacturing but expanding to tech sharing. No deal is finalized; Ford states it is discussing with many companies, some materializing, some not.

Potential Deal Elements

While no contract exists, reports outline core components:

| Aspect | Details | |

|---|---|---|

| Manufacturing Site | Valencia, Spain (primary); Cologne or Saarlouis, Germany (alternatives) | |

| Tariff Avoidance | Up to 37.6% on Chinese EV imports to the EU | |

| Tech Sharing | Geely’s G-ASD system with World Action Model (WAM) for self-driving in complex scenarios | |

| G-ASD Capabilities | Handles parking garages, roundabouts, toll gates; controls powertrain, brakes, screens | |

| Current G-ASD Use | Zeekr, Lynk & Co models |

Analysis: Manufacturing Synergies

Geely gains local production to slash costs and prices, making models like Zeekr competitive in Europe without tariff hits. Ford fills idle capacity—Valencia’s modern assembly lines suit EV builds—preserving jobs and revenue. This mirrors industry trends: Western firms lease space to cut fixed costs as the EV transition slows sales of traditional models.

Analysis: Technology Exchange

Geely’s Afari Technology offers G-ASD, a level 3+ system using WAM for contextual road learning. Ford, lagging in ADAS versus Chinese rivals, could integrate this into its EVs, accelerating features like eyes-off autonomy planned for 2028 on its Universal EV Platform. Farley has praised Chinese EV prowess, signaling openness to such tech.

Analysis: Risks and Unanswered Questions

Geopolitical tensions loom: US bans Chinese software in vehicles, though this targets Europe. EU scrutiny of Chinese production could arise. Which Geely models? Production volumes? Timeline? Details not yet confirmed. A deal could falter, as with the denied Xiaomi talks.

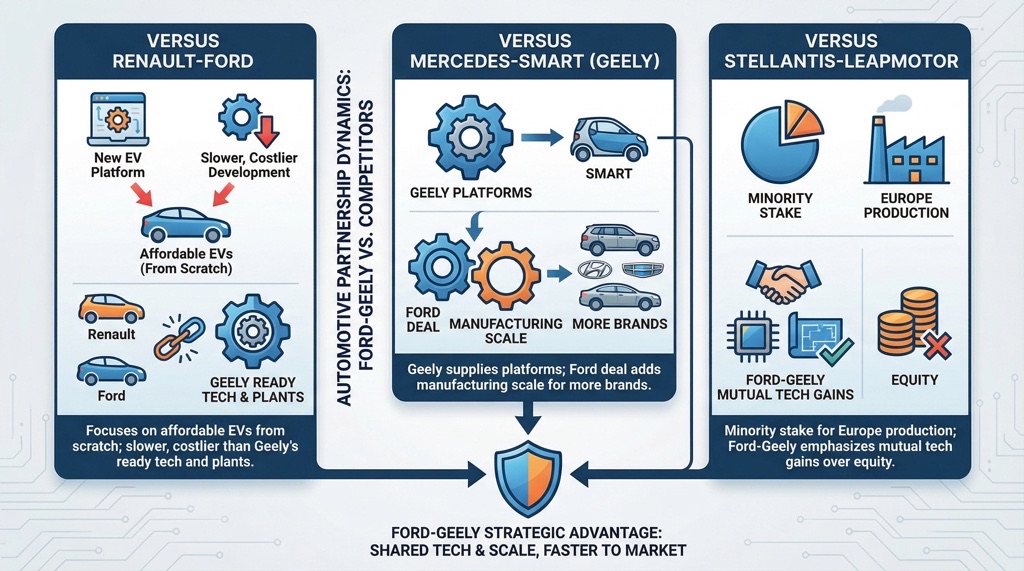

Comparison: Ford-Geely vs. Competitors

Versus Renault-Ford: Focuses on affordable EVs from scratch; slower, costlier than Geely’s ready tech and plants.

Versus Mercedes-Smart (Geely): Geely supplies platforms; Ford deal adds manufacturing scale for more brands.

Versus Stellantis-Leapmotor: Minority stake for Europe production; Ford-Geely emphasizes mutual tech gains over equity.

Verdict

This partnership positions Ford to survive the Chinese EV onslaught via pragmatic alliances, delivering cheaper local builds and advanced ADAS without solo investment. Ideal for Ford stakeholders seeking cost control and European regulators eyeing job protection. Geely buyers get tariff-free access; rivals must match. Watch for announcements—success here could redefine EV globalization, but failure underscores partnership fragility.