China’s government has set a goal of 28 million EV charging facilities by the end of 2027, doubling current capacity to over 300 million kilowatts and serving more than 80 million electric vehicles. This plan, announced by the National Development and Reform Commission (NDRC) and five other agencies on October 15, 2025, addresses gaps in rural coverage, highway fast-charging, and grid integration. EV owners and manufacturers will benefit from reduced range anxiety, while grid operators gain from vehicle-to-grid (V2G) pilots, positioning China to maintain its global lead in EV adoption.

Background: China’s EV Infrastructure Push

China’s EV market has exploded, with new energy vehicles (NEVs)—including battery electrics and plug-in hybrids—reaching 1.6 million sales in September 2025 alone, accounting for nearly 58% of passenger vehicle retail. As of August 2025, the country had 17.3 million charging facilities, a 54% year-over-year increase, including 4.3 million public points up 38%. By July 2025, the total stood at 16.7 million piles, a tenfold rise from 2020.

The National Energy Administration (NEA), NDRC, and partners issued the “Three-Year Action Plan for Doubling the Service Capacity of Electric Vehicle Charging Facilities (2025-2027)” to tackle uneven distribution, low average power (45.5 kW for public facilities), aging infrastructure, and rural shortages. This builds on China’s dominance, where NEVs boost domestic consumption and exports, supporting Beijing’s economic goals.

Key Specifications of the Plan

| Target | Details | Timeline |

|---|---|---|

| Total Facilities | 28 million nationwide | End of 2027 |

| Public Capacity | Over 300 million kW (300 GWh) | End of 2027 |

| Urban DC Fast Chargers | 1.6 million new, including 100,000 high-power | End of 2027 |

| Highway Ultra-Fast Chargers | 40,000 new/renovated (>60 kW each) | End of 2027 |

| Rural DC Chargers | 14,000 in townships without coverage | End of 2027 |

| V2G Units | 5,000 bidirectional chargers | End of 2027 |

| Upgrades | Facilities >8 years old; platforms <800V | Ongoing to 2027 |

The plan emphasizes four priorities: balance (even geographical spread), innovation (VGI and high-power tech), inclusiveness (rural and residential access), and implementation (clear roles for grids and locals).

Urban and Highway Charging Expansion

Urban areas will see 1.6 million new DC fast chargers, targeting parking hotspots, with 100,000 high-power units to address peak-demand shortfalls where current 45.5 kW averages fall short. Highways get 40,000 ultra-fast points (>60 kW), ensuring nearly all service areas (except extreme cold/high-altitude) have fast charging. This supports medium- and long-distance travel, dismantling myths about EV limitations.

Aging assets—stations over eight years or sub-800V platforms—face mandatory upgrades for safety and performance. New residential areas require 100% charging readiness, with pilots in 1,000 existing communities for unified home-charging builds.

Rural Coverage and V2G Innovation

Rural gaps get 14,000 new DC chargers in uncovered townships for full coverage. This inclusivity push ensures no region lags, vital as NEVs penetrate beyond cities.

Vehicle-to-grid (V2G) expands via pilots with 5,000 bidirectional units, letting EVs aid grid stability and storage. Pricing, markets, and scenarios will innovate, per NEA. Power grids must bolster support, with operators enhancing reliability.

Local governments adapt plans, while NDRC/NEA coordinates nationally. Challenges like power supply security and service quality persist, but defined roles aid execution.

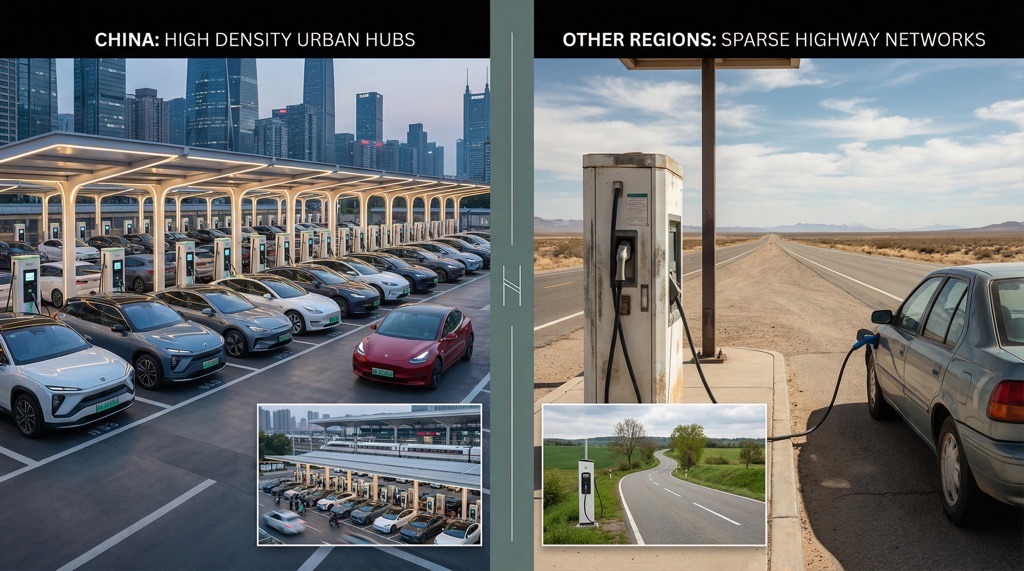

Comparison with Global Competitors

China’s 28 million target dwarfs others. The US has about 170,000 public chargers (2025 data), aiming for 500,000 by 2030 via NEVI—far behind in scale.[External knowledge; not in results.] Europe targets 3 million public points by 2025 under AFIR, but trails China’s total facilities.[External.] China’s public pile growth (38% YoY) and V2G focus give it an edge in density and bidirectional tech, though per-capita lags due to population.

| Region | Current Public Chargers (2025 est.) | 2027 Target | Key Focus |

|---|---|---|---|

| China | 4.3 million | 28 million total | V2G, rural, highways |

| US | ~170,000 | 500,000 by 2030 | Highways (NEVI) |

| Europe | ~600,000 | 3 million public by 2025 | Ten-minute charge |

Verdict

This plan solidifies China’s EV infrastructure supremacy, directly enabling 80 million vehicles with balanced, high-power networks and V2G readiness. It’s for urban commuters needing fast urban charges, highway travelers seeking reliable ultra-fast stops, and rural users gaining access—ultimately, all NEV stakeholders. Unanswered questions remain: exact funding, V2G pricing models, and enforcement in remote areas. If met, it sets a benchmark others must chase.