Volkswagen has launched the ID.UNYX 07 is being put into production at its Anhui plant, powered by the new China Electronic Architecture (CEA) developed in just 18 months. This zonal E/E architecture reduces electronic control units by 30%, enabling faster development and lower costs for software-defined vehicles in China. For EV buyers and investors, it signals VW’s aggressive push to reclaim market share amid a 44% drop in its China EV sales in 2025.

Background: VW’s Push for ‘China Speed’

Volkswagen’s business in China has faced headwinds, with overall sales declining 8% in 2025 and EV sales plummeting 44%. To counter this, VW adopted a ‘local for local’ and ‘China Speed’ strategy, partnering with Xpeng in 2023 and establishing the Volkswagen China Technology Company (VCTC) development center in Hefei. This setup allows on-site decisions without Wolfsburg oversight, accelerating innovation for the Chinese market.

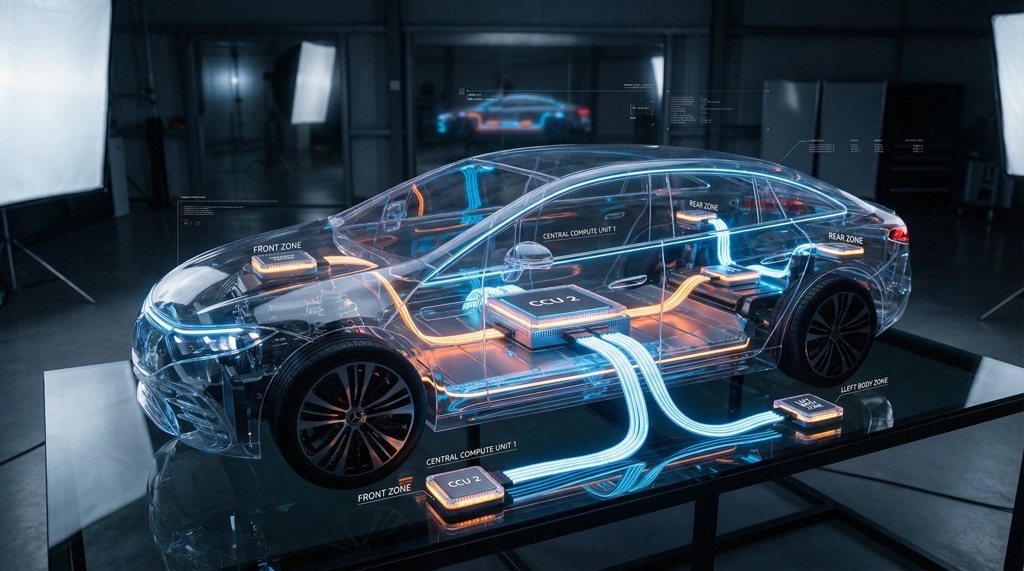

The CEA, a zonal electronic architecture with high-performance central computers, mirrors VW’s Rivian collaboration for Western markets but is tailored for China. Jointly developed by VCTC, CARIAD China, and Xpeng, it reached production readiness in 18 months—the fastest E/E architecture rollout in VW Group history. Production of the first model, ID.UNYX 07 began on December 31, 2025, at Volkswagen Anhui.

VW Group China plans over 20 new energy vehicle models in 2026, including five battery-electric models on CEA across its three joint ventures. The architecture supports A- to B-segment vehicles and all powertrains: BEVs, hybrids, and ICE.

Key Specifications

| Specification | Details |

|---|---|

| Model | ID.UNYX 07 |

| Length | 4.85 meters |

| Powertrain | 170 kW electric motor (BEV) |

| Architecture | CEA (zonal E/E with high-performance central computers) |

| ECU Reduction | 30% fewer vs. the previous generation |

| Development Time | 18 months to production |

| Production Start | December 31, 2025 (Anhui plant) |

| Upcoming Model | ID.UNYX 08 (SUV based on Xpeng G9) |

| Supported Features | AI cockpit, China-specific ADAS, full OTA updates |

Note: Battery capacity, range, and pricing details not yet confirmed.

Analysis: Efficiency Gains and Software-Defined Future

The CEA slashes electronic control units by 30%, reducing system complexity and providing a foundation for AI-powered cockpits, advanced driver-assistance systems (ADAS), and over-the-air (OTA) updates across the software-defined vehicle (SDV). This zonal design with central computing enables scalability and continuous software upgrades, positioning VW as the first to deploy such architecture at scale across powertrains.

Development cycles shorten by up to 30%, with costs cut by up to 50% for key models, thanks to local R&D and early supplier involvement. Production costs in China are 50% lower than in Germany, influenced by wages and exchange rates, per VCTC CEO Thomas Ulbrich. VW CEO Oliver Blume called it a milestone in the ‘In China, for China’ strategy, maintaining quality standards.

Analysis: Strategic Partnerships and Market Expansion

CEA supports VW’s intelligent connected vehicle (ICV) portfolio expansion, with four more models in 2026 from joint ventures. Ralf Brandstätter, VW Group China CEO, highlighted combining ‘China speed’ with VW engineering for rapid software innovation. Thomas Schäfer (or Ulbrich in sources) noted five BEV launches, including one pairing CEA with the localized CMP platform.

While focused on China, CEA aligns with VW’s global software ambitions, akin to its Rivian E/E work. Unanswered questions remain: exact performance specs for ID.UNYX 07 beyond the 170 kW motor, integration with VW’s MEB platform (ID.UNYX 07 appears distinct), and export potential.

Comparison with Competitors

| Aspect | VW CEA (ID.UNYX 07) | Xpeng P7 (Partner Influence) | BYD Seal | Tesla Model 3 (China) |

|---|---|---|---|---|

| Architecture | Zonal E/E, 30% fewer ECUs | Zonal with central compute | Centralized ‘Xuanji’ | Centralized HW4 |

| Development Time | 18 months | ~24 months (est.) | Proprietary, rapid | Global iterations |

| Power (Base) | 170 kW | 217 kW (RWD) | 160-390 kW | 194 kW (RWD) |

| Market Focus | China BEV/hybrid/ICE | China premium EV | Global mass-market | Global premium |

| Cost Savings | Up to 50% dev costs | Software-centric | Vertical integration | Scale efficiencies |

VW’s CEA matches Xpeng’s tech edge while leveraging VW scale; it trails BYD’s integration but beats Tesla in localization speed. ID.UNYX 07’s shorter length (vs. ID.7) targets compact sedan demand.

Verdict

VW’s CEA launch with ID.UNYX 07 proves ‘China Speed’ works, delivering a scalable platform that cuts costs and complexity for SDVs—ideal for fleet buyers, tech enthusiasts, and investors eyeing VW’s China recovery. It’s a buy for those prioritizing OTA upgradability and ADAS in mid-size EVs, but wait for range/pricing confirmation before committing. Competitors like BYD lead in affordability; VW must execute 2026 launches flawlessly to close the gap.