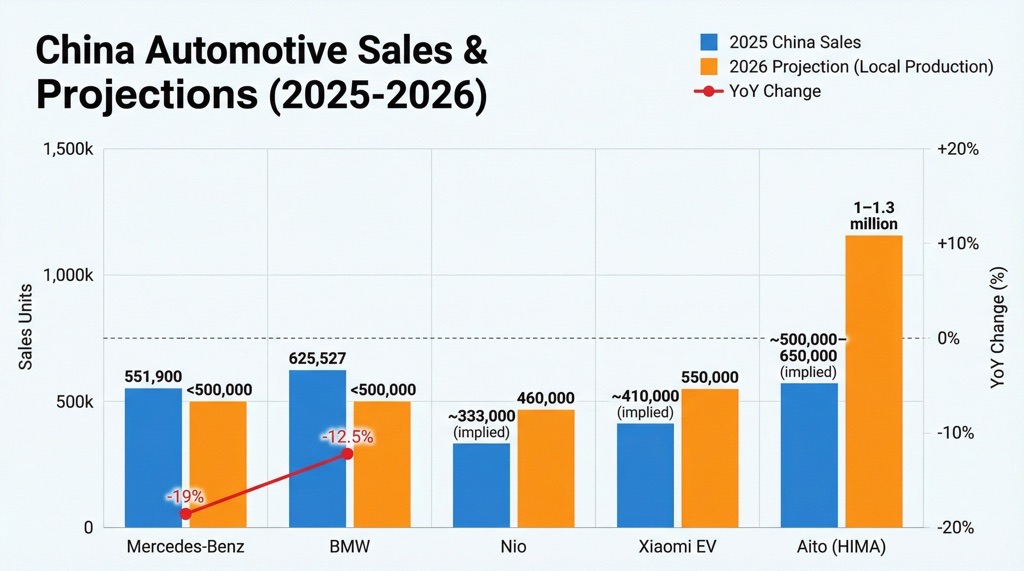

Mercedes-Benz and BMW project fewer than 500,000 locally produced vehicles sold each in China for 2026, levels not seen in a decade, as domestic EV brands like Nio, Xiaomi, and Aito set aggressive growth targets. This cautious outlook follows 2025 sales declines of 19% for Mercedes-Benz (551,900 units) and 12.5% for BMW (625,527 units), signaling intensifying competition in the world’s largest auto market, where new energy vehicle penetration exceeded 50% last year. Readers tracking EV investments or luxury markets should note this shift, as it underscores how faster local innovation in software, pricing, and electrification is eroding German dominance.

Background: German Luxury Giants Face Shifting Tides in China

Mercedes-Benz and BMW have long dominated China’s premium segment, but consecutive double-digit sales drops highlight mounting pressures. In 2025, Mercedes-Benz delivered 551,900 vehicles in China, down 19% year-over-year, while BMW sold 625,527 units, a 12.5% decline, marking the second straight year of over 10% drops for both. These figures revert demand forecasts to levels from roughly ten years ago, per preliminary guidance shared with Chinese suppliers, as reported by 36Kr.

China remains the world’s largest auto market, with new energy vehicles (NEVs)—including battery electrics and plug-in hybrids—surpassing 50% market penetration in 2025. Domestic brands are accelerating on key fronts: superior software integration, competitive pricing, and rapid model refreshes. German brands’ EVs, despite advancements like Mercedes-Benz’s CLA with 866 km range and BMW’s 53,000 pure-EV units in 2025 (under 10% of total sales), lag in volume share.

Key Sales Figures and Projections

| Brand | 2025 China Sales | YoY Change | 2026 Projection (Local Production) |

|---|---|---|---|

| Mercedes-Benz | 551,900 units | -19% | <500,000 units |

| BMW | 625,527 units | -12.5% | <500,000 units |

| Nio | ~333,000 (implied) | – | 460,000 units (40-50% growth) |

| Xiaomi EV | ~410,000 (implied) | – | 550,000 units (+34%) |

| Aito (HIMA) | ~500,000-650,000 (implied) | – | 1-1.3 million units (+120%) |

Note: Chinese brand 2025 baselines derived from 2026 targets; exact prior-year figures not specified in sources.

Product Strategies: Aggressive Launches Meet Skepticism

Both German brands are countering with extensive lineups. Mercedes-Benz plans 15 facelifts and new models for 2026, including a long-wheelbase electric GLC and the first locally built GLE. Its recent CLA launch in November 2025 featured up to 866 km range and Momenta-partnered advanced driver assistance, yet November-December sales totaled just 1,369 units.

BMW intends to introduce the next-generation iX3 plus over 20 models. Despite 53,000 pure-EV sales in 2025—better than Mercedes—EVs comprised less than 10% of total China volume, with models like the i3 seeing prices drop below RMB 200,000, eroding brand premium. These efforts aim to reclaim share, but suppliers’ revised forecasts suggest limited impact.

Domestic EV Momentum: Sales Records and Ambitious Targets

Local premium brands exude confidence. Nio targets 40-50% growth to ~460,000 units in 2026, bolstered by its refreshed ES8 hitting 22,000 monthly sales in December 2025—the top large SUV over $57,000. Xiaomi EV eyes 550,000 units (+34%), while Huawei-backed Aito (Harmony Intelligent Mobility Alliance) aims for 1-1.3 million, doubling prior sales; its M8 and M9 each exceeded 100,000 annual units.

Even ultra-luxury finds takers: Maextro S800, priced above RMB 700,000 (~$97,000), delivered over 4,000 units in a month. Broader trends show Chinese automakers like XPeng targeting 600,000 units (+40%) and overall industry NEV ambitions soaring, contrasting restrained goals from players like BYD (5-5.5 million total, ~9% growth). This surge stems from advantages in intelligent driving, user experience, and ecosystem integration.

Analysis: Why German Brands Are Losing Ground

Local brands outpace in electrification speed and pricing. China’s NEV policies and consumer shift to software-rich vehicles favor domestics, who iterate faster via data loops and supply chain proximity. German EVs trail in adoption despite specs; BMW i3 discounts signal profitability strains. Unanswered: Will 2026 launches reverse trends, or deepen discounting?

Geopolitical tensions and export focus may divert resources, but the core issue is execution. Sources note German caution versus domestic optimism, with no official rebuttals from BMW or Mercedes. Critical view: Forecasts could prove conservative if macroeconomic recovery aids, yet local momentum appears structural.

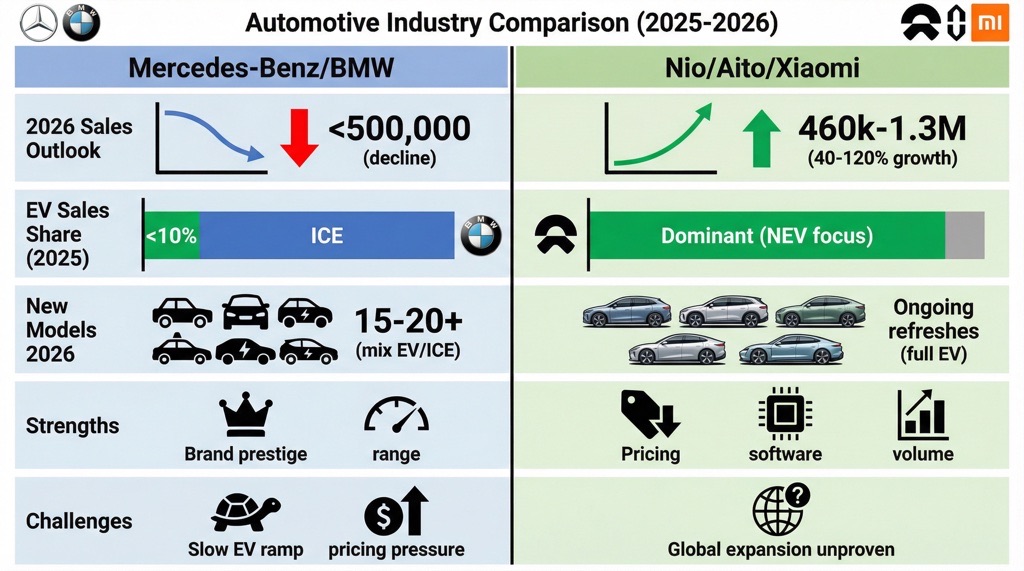

Comparison: German Icons vs. Chinese Challengers

| Aspect | Mercedes-Benz/BMW | Nio/Aito/Xiaomi |

|---|---|---|

| 2026 Sales Outlook | <500,000 each (decline) | 460k-1.3M (40-120% growth) |

| EV Sales Share (2025) | <10% (BMW) | Dominant (NEV focus) |

| New Models 2026 | 15-20+ (mix EV/ICE) | Ongoing refreshes (full EV) |

| Strengths | Brand prestige, range | Pricing, software, volume |

| Challenges | Slow EV ramp, pricing pressure | Global expansion unproven |

Germans hold legacy appeal but cede ground on agility; locals win on current market fit.

Verdict: Wake-Up Call for Luxury EV Strategy

Mercedes-Benz and BMW’s sub-500,000 forecasts signal a pivotal moment—local EVs are not just competing but reshaping China’s premium landscape. This suits investors eyeing domestic growth stocks like Nio or Aito over traditional luxury, and buyers prioritizing software ecosystems over badges. German brands must accelerate localization and innovation to compete; otherwise, 2026 could mark deeper erosion. Details on the exact 2016 baselines and full 2026 lineups remain unconfirmed.