China will release its first national standard for automotive solid-state batteries in July 2026, establishing unified definitions and classification frameworks as mass production of these next-generation cells begins. The move marks a critical regulatory milestone for an industry currently lacking any international automotive-grade standards, positioning China to shape global technical requirements for solid-state battery technology.

What the Standard Covers

The standard, titled “Solid-State Batteries for Electric Vehicles — Part 1: Terminologies and Classification,” was completed as a draft for public consultation in December 2025. It represents the first installment in a planned four-part series, with future parts expected to address performance benchmarks, safety requirements, and lifespan criteria.

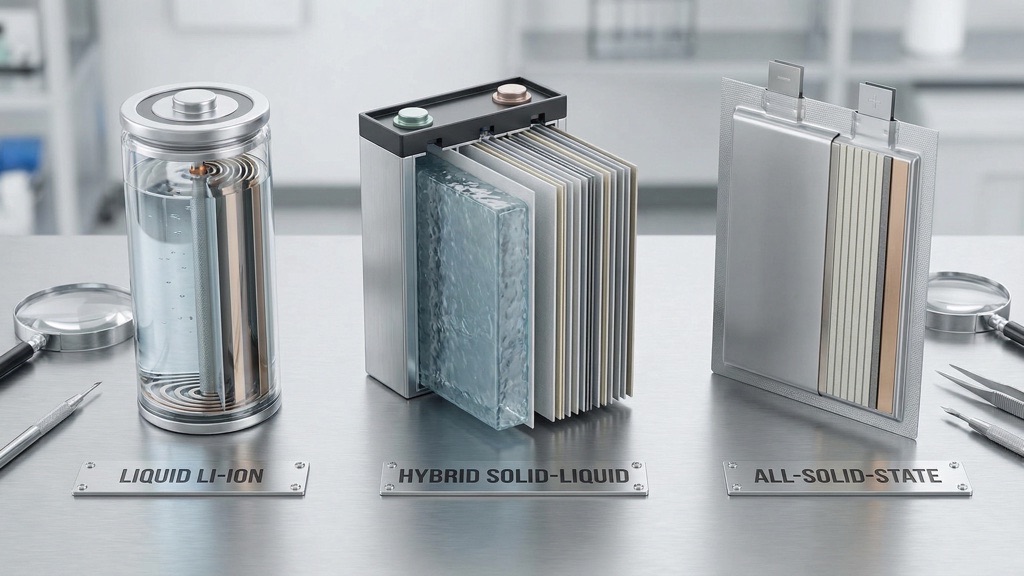

The framework eliminates industry confusion by formally categorizing batteries into three distinct types based on the ion transfer mechanism:

| Battery Type | Definition |

|---|---|

| Liquid | Conventional batteries using liquid electrolytes |

| Hybrid solid-liquid | Batteries containing both liquid and solid electrolyte phases |

| Solid-state | Batteries using only solid electrolytes |

Notably, the standard eliminates the marketing term “semi-solid-state,” which previously created ambiguity in the market. Solid-state batteries are further subdivided by electrolyte material (sulfide, oxide, polymer, halide, or composite), conducting ion (lithium or sodium), and application focus (high-energy or high-power).

Stricter Qualification Criteria

A defining feature of China’s standard is its 0.5% weight loss threshold for qualifying as a true solid-state battery under vacuum drying conditions. This represents a significant tightening from the 1% limit established by the China Society of Automotive Engineers in May 2025. The weight loss metric measures liquid electrolyte content—lower figures indicate fewer liquid components and greater solidity.

According to the drafting committee, genuine solid-state battery products consistently achieve sub-0.5% loss rates, while hybrid designs relying on residual liquid electrolytes typically do not. This stricter criterion will help prevent manufacturers from misclassifying semi-solid batteries as fully solid-state products.

EV Charge & Range Calculator

https://www.bike-ev.com/calculator/

It helps estimate:

- How far an EV can travel on a given battery size

- How charging to 80% vs 100% impacts usable range

- Why even a 20% energy-density improvement can significantly change daily usability

This puts LMFP’s laboratory results into a real-world context.

Strategic Timing and Market Impact

The standard’s July 2026 release aligns with the industry’s transition from laboratory research to commercial production. CITIC Securities projects small-batch solid-state battery production in 2026-27, with large-scale commercialization expected by 2030. Global demand for solid-state and hybrid solid-liquid batteries is forecast to exceed 700 gigawatt-hours by 2030, with solid-state batteries accounting for 200 GWh.

Dongfeng, a major Chinese automaker, has already completed a 0.2 GWh solid-state battery pilot production line with units rolling off the line, targeting mass production by September 2026. The company’s batteries have demonstrated 1,000+ km (620+ miles) driving range and passed thermal tests exceeding national safety standards.

Competitive Advantage

By establishing the world’s first national solid-state battery standard, China gains a first-mover advantage in shaping global technical rules for next-generation battery technology. No unified international standard currently exists, giving Chinese regulators and manufacturers significant influence over how the technology will be defined and commercialized globally. This regulatory framework is expected to accelerate supply-chain coordination and reduce technical confusion across the industry.

Verdict

China’s July 2026 solid-state battery standard represents a watershed moment for the EV industry. By establishing clear definitions and stricter qualification criteria, the standard will eliminate marketing ambiguity and accelerate the transition from pilot production to mass manufacturing. For EV manufacturers, battery suppliers, and investors, this regulatory clarity is essential—it signals that solid-state batteries are moving from theoretical promise to commercial reality. The standard is particularly significant for Chinese automakers, who will gain a competitive advantage through early standardization before international norms emerge.