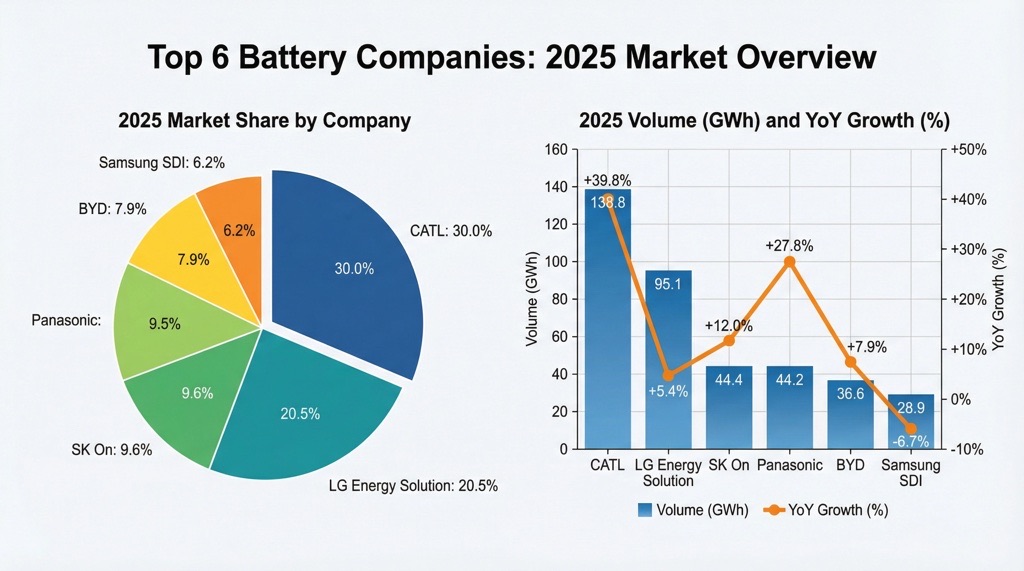

The global market for EV batteries outside China reached 463.3 GWh in 2025, up 26% from 2024, driven by rising demand for electric vehicles, plug-in hybrids, and hybrids. CATL led with 138.8 GWh and 30% share, highlighting Chinese dominance even beyond domestic borders. This growth underscores accelerating EV adoption worldwide, pressuring Western manufacturers to match Asian supply chains.

Background

SNE Research tracked battery installations for electrified transport, excluding China, capturing non-domestic market dynamics. CATL, the world’s largest battery maker, boosted its volume by 39.8% to claim first place. This data aligns with broader trends: global EV battery demand hit around 900 GWh in 2024, surging to an estimated 1,187 GWh including China in 2025 per SNE figures elsewhere. Chinese firms like CATL and BYD expanded internationally amid policy pushes in the US, EU, and India.

South Korean producers—LG Energy Solution, SK On, and Samsung SDI—collectively lost 7.4 percentage points of market share, dropping to 36.3%. Their slower growth (5.4% for LG, 12% for SK On, -6.7% for Samsung) contrasts with Chinese gains, fueled by cost-competitive lithium iron phosphate (LFP) cells and integrated supply chains.

Key Specifications

| Rank | Company | 2025 Volume (GWh) | YoY Growth | Market Share |

|---|---|---|---|---|

| 1 | CATL | 138.8 | +39.8% | 30.0% |

| 2 | LG Energy Solution | 95.1 | +5.4% | 20.5% |

| 3 | SK On | 44.4 | +12.0% | 9.6% |

| 4 | Panasonic | 44.2 | +27.8% | 9.5% |

| 5 | BYD | 36.6 | +7.9% | 7.9% |

| 6 | Samsung SDI | 28.9 | -6.7% | 6.2% |

Dominance of Chinese Makers

CATL’s 39.8% growth outpaced the market, leveraging LFP chemistry popular for its safety and lower cost—now over 90% of global lithium-ion demand. Globally, CATL installed 464.7 GWh, including China, securing 39.2% share. This international push coincides with battery costs dropping 70% since 2015, enabling broader EV affordability.

Challenges for Korean and Japanese Firms

LG Energy Solution’s share slipped from 24.5% to 20.5% despite volume gains, as competitors scaled faster. Samsung SDI’s decline marks it as the outlier amongthe top players. Panasonic, Tesla’s key supplier, grew 27.8% but trails SK On slightly. These shifts reflect supply chain pressures and slower adaptation to LFP versus nickel-based chemistries.

Market Comparison

Outside China, CATL’s 30% dwarfs LG’s 20.5%. Globally, CATL (39.2%) and BYD (16.4%) control 55.6%, versus non-China, where Koreans hold 36.3%. Compared to 2024’s ~367 GWh (implied by 26% growth), 2025’s 463.3 GWh nears half of total global demand, signaling non-Chinese markets absorbing more Asian exports.

Verdict

This 26% surge to 463.3 GWh confirms EV batteries as the backbone of electrification outside China, with CATL’s lead pressuring rivals to innovate. Ideal for OEMs like Tesla, Volkswagen, and emerging players in the US/EU eyeing cost-competitive sourcing. Unanswered: exact non-China splits for solid-state or sodium-ion tech, and if Korean firms rebound via US IRA incentives.