BYD plans to install all-solid-state batteries in high-end EVs by 2027, achieving 400 Wh/kg energy density and over 1,200 km range, while unveiling sodium-ion batteries with 10,000 cycles. These developments position BYD to challenge lithium-ion limits in safety, lifespan, and cost for electric vehicles. EV buyers and investors should note this accelerates premium EV performance without current production delays.

Background

BYD, the world’s second-largest power battery maker behind CATL, dominates with lithium iron phosphate (LFP) batteries in its EV lineup. The company disclosed these battery advances during a February 2026 investor briefing, reiterating timelines for sulfide solid-state batteries and revealing third-generation sodium-ion tech. Solid-state batteries replace flammable liquid electrolytes with solids, boosting safety and energy density, while sodium-ion batteries offer cheaper alternatives using abundant materials.

BYD’s battery strategy spans LFP dominance alongside explorations in ternary lithium, sodium, and now solid-state routes like sulfide composites with high-nickel cathodes and silicon anodes. This multi-path approach addresses EV pain points: range anxiety, charging speed, and battery replacement costs. Competitors like CATL plan sodium-ion trials in 2026 vehicles with Changan, while both firms eye 2027 solid-state demos.

Key Specifications

| Feature | Solid-State Battery | Sodium-Ion Battery |

|---|---|---|

| Energy Density (cell) | 400 Wh/kg | Details not yet confirmed |

| Volumetric Density | >800 Wh/L | N/A |

| Pack Density | >280 Wh/kg | N/A |

| Range (vehicle) | >1,200 km (high-end coupe) | N/A |

| Cycle Life | 10,000 cycles | 10,000 cycles |

| Fast Charging | 5C (80% in 10 min) | Details not yet confirmed |

| Low-Temp Performance | 85% at -30°C | Details not yet confirmed |

| Production Start | 2027 small batch (1,000 units) | TBD by demand |

| Cost Target | $70/kWh | N/A |

Solid-State Battery Roadmap

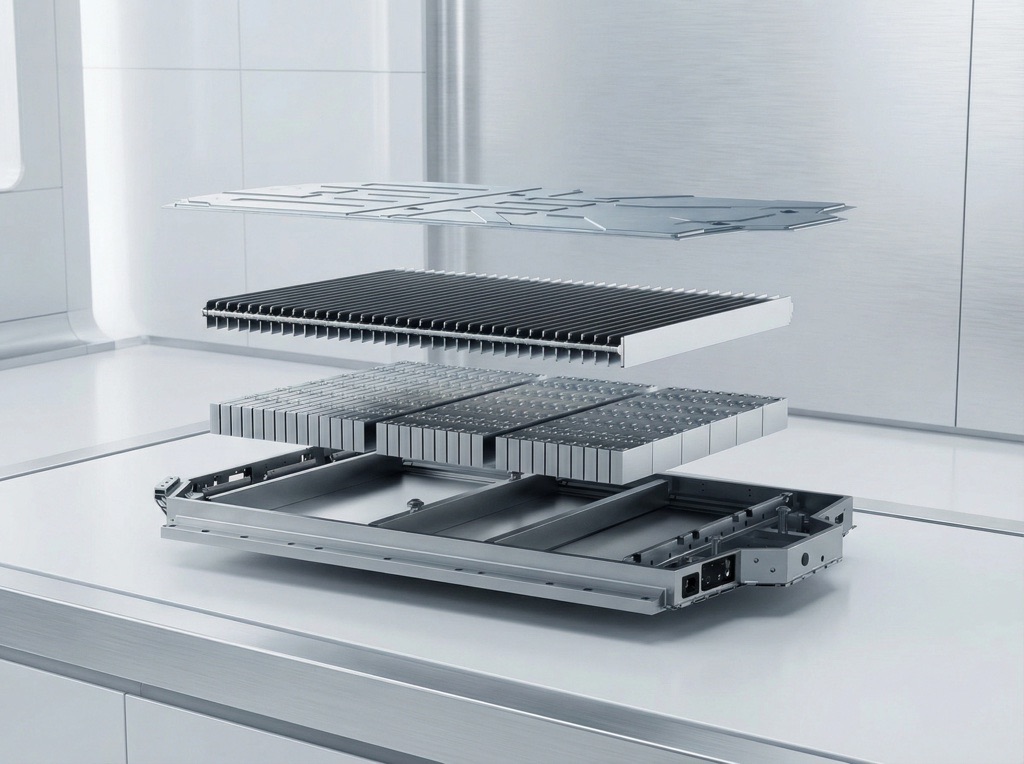

BYD’s all-solid-state batteries follow a clear timeline: 2024 pilot production of 60Ah cells, 2025-2026 vehicle testing including -40°C cold and 120°C heat extremes, and 2027 batch installs in high-end coupes from Chongqing’s 20 GWh line. By 2030, expansion to 40,000 vehicles matches liquid battery pricing, with full replacement post-2030 at 556 GWh global scale. Breakthroughs tackle solid-solid interface impedance, enabling high conductivity and safety via nail penetration tests.

Sulfide electrolytes lead BYD’s route for ionic conductivity, supporting 2027 commercialization ahead of oxide or polymer paths. Challenges persist: production complexity, low-temp decay (25% at -20°C), and charging infrastructure limits. These batteries promise over 1,000 km range packs, far exceeding current LFP limits.

Sodium-Ion Advancements

BYD’s third-generation sodium-ion platform solves sodium precipitation and heat issues via poly-anion materials, hitting 10,000 cycles—double LFP’s 2,000-3,000 for EVs and matching energy storage. Mass production awaits market demand, unlike CATL’s Naxtra at 175 Wh/kg for 2026 Changan vehicles. Sodium’s cost edge from abundant sourcing suits budget EVs, though density trails LFP slightly.

General research echoes safety gains: solid-state sodium prototypes show 99.26% efficiency over 600 cycles, non-flammable vs. lithium-ion. BYD’s dual focus hedges against lithium shortages.

Comparison with Competitors

| Aspect | BYD Solid-State | CATL Sodium (Naxtra) | Changan Solid-State |

|---|---|---|---|

| Timeline | 2027 small-scale | 2026 vehicles | 2026 verification, 2027 mass |

| Cycles | 10,000 | Details not confirmed | N/A |

| Density | 400 Wh/kg | 175 Wh/kg | N/A |

| Focus | Premium range | Budget supply | Gradual mass |

BYD leads solid-state vehicle integration; CATL prioritizes sodium partnerships.

Verdict

BYD’s 2027 solid-state and sodium batteries deliver concrete gains in cycles, safety, and range for premium EVs, with $70/kWh costs closing parity gaps. Ideal for high-end buyers seeking 1,200+ km without swaps, but low-temp and scale hurdles remain unanswered. Watch 2026 tests for delivery—BYD edges ahead if timelines hold.