Changan Automobile and CATL have unveiled the Nevo A06 (also known as Qiyuan A06), the world’s first mass-produced passenger EV with sodium-ion batteries. Equipped with a 45 kWh CATL Naxtra pack at 175 Wh/kg energy density, it offers over 400 km pure electric range, with winter testing completed in -30°C conditions. This mid-2026 launch across Changan’s brands targets cold climates and cost-sensitive markets where lithium supply constraints loom.

Background: Changan and CATL’s Push into Sodium-Ion

Changan Automobile, a state-owned Chinese automaker, holds a strong position in the domestic EV market through brands like Deepal, Avatr, Qiyuan, and UNI (Nevo). As China’s EV sales surge, Changan partners exclusively with CATL for sodium-ion batteries, integrating them across all brands starting mid-2026. CATL, the global leader in lithium-ion batteries, began sodium-ion R&D in 2016, investing nearly RMB 10 billion ($1.44 billion), testing 300,000 cells with over 300 personnel, including 20+ PhDs.

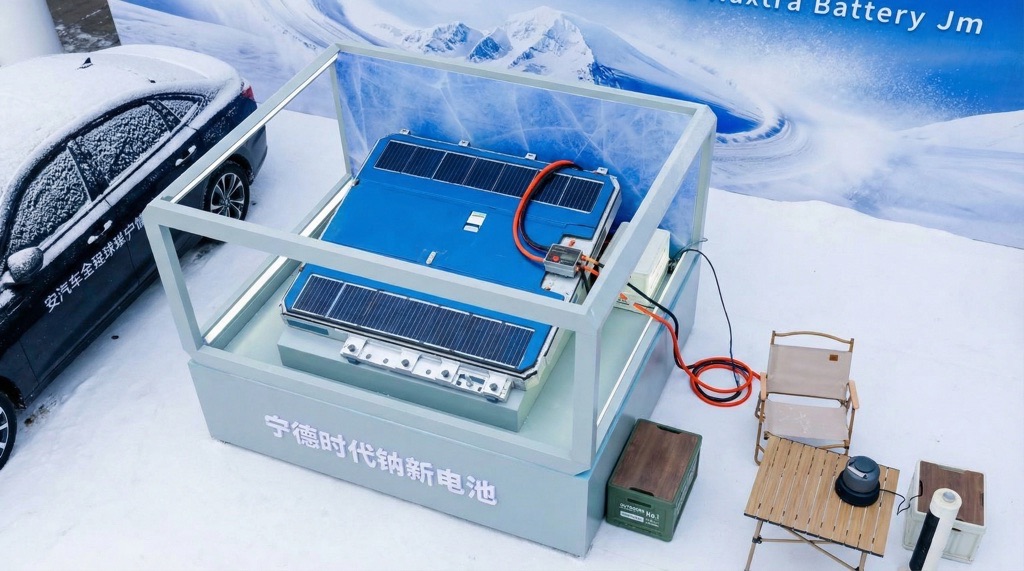

The Naxtra sodium-ion battery debuted in April 2025, first for commercial vehicles like vans, before passenger EVs. While Yiwei (JAC) launched a sodium-ion small car in 2024 with Hina Battery cells, no prior mass-produced passenger model exists. CATL plans 3,000 Choco-Swap stations in 140+ cities by 2026, including 600+ in cold northern regions, supporting dual sodium-lithium swapping.

Key Specifications

| Specification | Details |

|---|---|

| Battery | CATL Naxtra sodium-ion, 45 kWh, 175 Wh/kg energy density |

| Pure EV Range | >400 km (CLTC), potential 500-600 km future |

| Cold Weather Performance | 90%+ capacity at -40°C, discharge at -50°C; 3x power vs LFP at -30°C |

| Safety | No fire/explosion under crush, drill, saw tests; continues discharge post-damage |

| Launch | Mid-2026, winter-tested in Yakeshi, Inner Mongolia |

| Brands | Avatr, Deepal, Qiyuan/Nevo, UNI/Viva |

| Cycles | >10,000 (Tectrans II series reference) |

Performance Analysis: Cold Resistance and Safety Lead

The Nevo A06’s sodium-ion pack excels in extreme cold, retaining over 90% capacity at -40°C and enabling stable discharge at -50°C—critical for northern China, where lithium batteries falter. At -30°C, discharge power reaches nearly three times that of comparable LFP packs, verified in Yakeshi winter calibration. Paired with CATL’s third-gen CTP and BMS, it achieves precise range display exceeding 400 km CLTC.

Safety stands out: fully charged cells withstand crushing, drilling, and sawing without thermal runaway, even discharging after being sawn. This surpasses national standards, addressing EV fire concerns. Energy density matches LFP at 175 Wh/kg, with a roadmap to 600 km range as supply chains mature.

Strategic Implications: Dual-Chemistry Ecosystem

CATL’s CTO Gao Huan calls it the “dual-chemistry era,” blending sodium for cold/safety with lithium for density. Changan accelerates adoption per the national strategy for affordable, durable EVs. Supporting infrastructure includes 3,000 swap stations, though sodium-specific allocation remains unspecified. Challenges persist: sodium-ion lags lithium in density, and mass production scalability is unproven beyond pilots.

Unanswered questions include exact pricing, full specs for other brands, and GAC/JAC rollout timelines mentioned in earlier reports. Real-world range beyond CLTC and cycle life in passenger use needs post-launch data.

Comparison with Competitors

| Model/Tech | Energy Density (Wh/kg) | Range (km) | Cold Performance | Status |

|---|---|---|---|---|

| Changan Nevo A06 (Sodium) | 175 | >400 (now), 600 (future) | 90% at -40°C | Mass-prod mid-2026 |

| Yiwei (Hina Sodium, 2024) | Not specified | Not specified | Not specified | Launched a small car |

| CATL LFP (Typical) | ~175 | 400-500[general] | Weaker in cold | Widespread |

| BYD Blade LFP | ~150-160 | 400-600 | Moderate cold[general] | Mass-produced |

Nevo A06 edges LFP in cold/safety but matches density; Yiwei pioneered but lacks scale. Upcoming GAC Aion or JAC may compete soon.

Verdict

Changan Nevo A06 sets a benchmark for sodium-ion passenger EVs, ideal for cold-region commuters needing reliable 400+ km range without lithium costs/volatility. Best for budget-conscious buyers in harsh climates, but wait for 2026 pricing and field data before committing—lithium remains superior for high-density needs. This dual-tech shift strengthens China’s EV dominance if infrastructure scales.