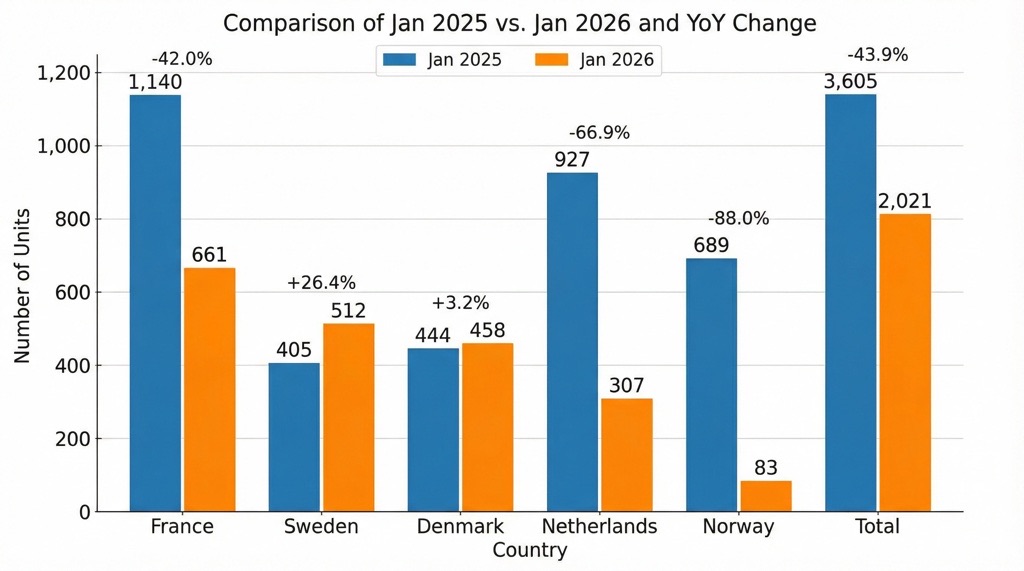

Tesla’s European registrations fell 44% year-over-year in January 2026 across five key markets, marking the worst monthly start yet and extending a three-year decline trend. This drop from 3,605 units in January 2025 to 2,021 units signals deepening challenges amid rising competition and policy shifts, raising questions about Tesla’s continental recovery.

European buyers, once Tesla’s stronghold, are shifting to fresher models from Volkswagen and Chinese rivals, while incentive cuts expose Tesla’s premium pricing vulnerabilities. For EV investors and enthusiasts tracking market share, this data underscores a pivotal shift in Europe’s electrification race.

Background: Tesla’s Eroding Dominance in Europe

Tesla entered Europe as an EV pioneer around 2013, quickly capturing market leadership with the Model S and later Model 3 and Y. By 2021, Tesla held a near-monopoly in battery-electric vehicle (BEV) registrations, benefiting from aggressive subsidies and limited competition. However, sales peaked in 2023 at around 360,000 units before entering a sustained downturn.

In 2024, registrations slipped roughly 10% to 326,000 units. The decline sharpened in 2025 to 235,000 units, a 27.8% drop, even as Europe’s overall BEV market grew 30% to 2.6 million units. Volkswagen overtook Tesla that year with 274,000 BEVs, up 56% year-over-year, driven by models like the ID.4 (80,000+ units) and ID.3 (79,000 units).

January 2026 data from France, Sweden, Denmark, the Netherlands, and Norway confirm the slide persists. These markets represent a significant slice of Europe’s EV sales, with more data from Germany, UK, Italy, and Spain pending. Germany’s 2025 drop of 48% to 19,000 units foreshadows potential further pain.

Key Specifications: January 2026 Tesla Registrations

| Country | Jan 2025 | Jan 2026 | YoY Change |

|---|---|---|---|

| France | 1,140 | 661 | -42.0% |

| Sweden | 405 | 512 | +26.4% |

| Denmark | 444 | 458 | +3.2% |

| Netherlands | 927 | 307 | -66.9% |

| Norway | 689 | 83 | -88.0% |

| Total | 3,605 | 2,021 | -43.9% |

Source: Aggregated registration data from national auto associations via Electrek analysis. Note: Sweden and Denmark gain follow depressed 2025 baselines; Sweden remains 29% below January 2024.

Analysis: Factors Fueling Tesla’s European Decline

Policy Shifts and Incentive Losses

Norway’s 88% plunge stems directly from the end of EV incentives on January 1, 2026, triggering a Q4 2025 sales rush—industry-wide registrations fell 76%. France’s 42% drop lacks such excuses, hitting a three-year low of 661 units. The Netherlands saw Tesla fall to fifth among EV brands.

Higher prices make Tesla more sensitive to subsidy cuts than budget options from BYD or Volkswagen. Europe’s patchwork incentives continue evolving, with Germany and others tightening rules amid fiscal pressures.

Product Aging and Competition Surge

The Model Y, Europe’s top-selling EV in 2025 at 151,000 units, is over four years old without major updates, facing fresher rivals like Volkswagen’s ID.4 (up 24%) and ID.7 (up 137%). Chinese brands like BYD are gaining market share via lower prices and rapid model refreshes.

Volkswagen’s broad lineup—spanning hatchbacks to SUVs—captures diverse buyers, contrasting Tesla’s SUV-heavy focus. Tesla’s first-mover edge fades as legacy makers leverage local production and dealer networks.

Brand Perception Challenges

Elon Musk’s political stances have alienated Europe’s eco-focused buyers, per market commentary. This “brand damage” compounds product issues, as consumers avoid vehicles tied to controversy despite engineering merits.

While refreshed Model 3 and Y launches aim to counter this, they enter a market where perception lags. Unanswered: Will pricing adjustments or autonomy features reverse sentiment?

Comparison: Tesla vs. Key European EV Rivals

| Brand | 2025 Europe BEV Sales | YoY Change | Key Models | Strengths |

|---|---|---|---|---|

| Tesla | 239,000 | -27% | Model Y (151k), Model 3 | Brand recognition, supercharger network |

| Volkswagen | 274,000 | +56% | ID.4 (80k+), ID.3 (79k), ID.7 (76k+) | Broad lineup, local production |

| BYD | Details not yet confirmed | N/A | Atto 3, Seal | Low pricing, rapid expansion |

Volkswagen’s surge flipped 2024’s Tesla lead. BYD’s rise in the Netherlands highlights the Chinese threat, though the exact 2025 volumes await confirmation.

Verdict: Tesla’s European Floor Remains Elusive

Tesla’s 44% January drop across monitored markets confirms an accelerating crisis—three years of declines with no rebound in sight. This suits risk-tolerant investors betting on global diversification or autonomy pivots, but European EV buyers prioritizing value and subtlety will favor Volkswagen’s scale or BYD’s affordability. Critical gaps persist: full-month data, refreshed model impacts, and brand repair strategies. Without bold moves, Tesla risks ceding Europe’s EV leadership permanently.