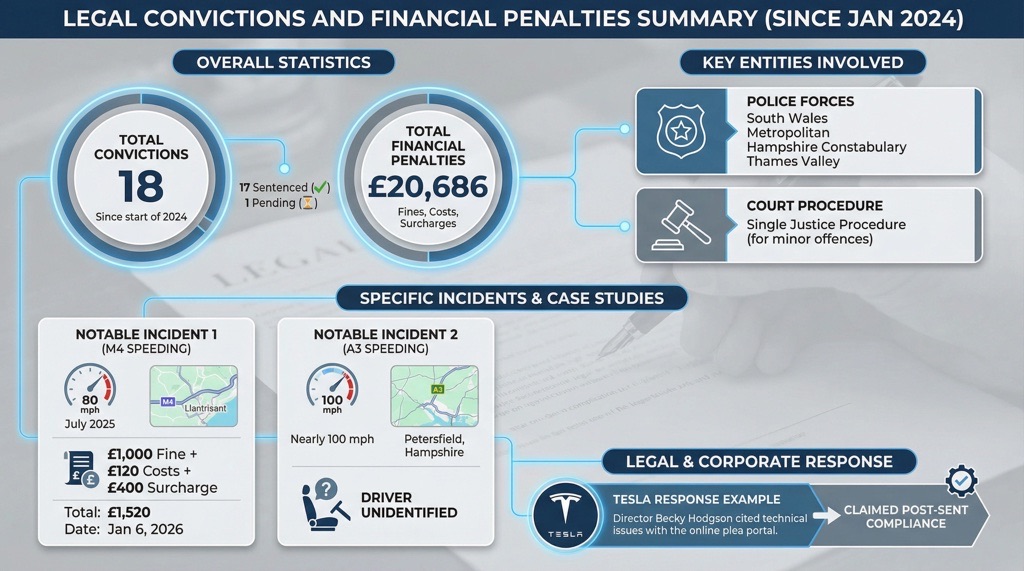

Tesla Financial Services has been convicted 18 times since 2024 for failing to provide driver details to UK police in road traffic cases, resulting in fines totaling £20,686. This stems from leased Tesla vehicles involved in speeding offences, where the company failed to respond to requests. EV owners and lessees should note this could impact how violations are handled and raises questions about Tesla’s compliance processes in key markets like the UK.

Background: Tesla’s UK Market Dominance Amid Legal Scrutiny

Tesla remains the leading electric vehicle brand in the UK, registering 45,513 new vehicles in the past year, with the Model Y (24,298 units) and Model 3 (21,188 units) topping sales charts. Despite this strong position, Tesla Financial Services, the arm handling leasing, has faced repeated legal challenges. Under UK law, police can require registered keepers—often leasing firms for rented vehicles—to identify drivers in traffic offences. Non-compliance leads to separate criminal charges against the company.

The issue surfaced prominently in court records reviewed by the Press Association, which showed prosecutions by forces including South Wales Police, Metropolitan Police, Hampshire Constabulary, and Thames Valley Police. Tesla’s failures span two years, with 17 cases sentenced and one pending at Bath Magistrates’ Court.

Key Specifications of the Cases

| Aspect | Details |

|---|---|

| Total Convictions | 18 since start of 2024 (17 sentenced, 1 pending) |

| Total Fines, Costs, Surcharges | £20,686 |

| Key Police Forces Involved | South Wales, Metropolitan, Hampshire Constabulary, Thames Valley |

| Notable Incident 1 | 80 mph on M4 near Llantrisant (July 2025); £1,000 fine + £120 costs + £400 surcharge (Jan 6, 2026) |

| Notable Incident 2 | Nearly 100 mph on A3 in Petersfield, Hampshire; driver unidentified |

| Tesla Response Example | Director Becky Hodgson cited technical issues with the online plea portal and claimed post-sent compliance |

| Court Procedure | Single Justice Procedure for minor offences |

Case Breakdown: Speeding Incidents and Court Outcomes

One prominent case involved South Wales Police contacting Tesla after a vehicle was clocked at 80 mph on the M4 near Llantrisant, Rhondda Cynon Taf, on July 4, 2025. Tesla Financial Services did not identify the driver, leading to a guilty plea by director Becky Hodgson in November 2025. She explained via email that the company faced technical issues with the Online Plea Service portal, but believed it had complied by sending details via post. Merthyr Tydfil Magistrates’ Court rejected this on January 6, 2026, imposing a £1,000 fine, £120 costs, and £400 victim surcharge.

Another incident saw a Tesla nearly hitting 100 mph on the A3 in Petersfield, Hampshire, with police correspondence unanswered, resulting in a conviction. A separate case involved a driver caught speeding three times—potentially licence-losing—but unidentified, shifting penalties to Tesla. These patterns highlight systemic issues in Tesla’s response process for leased vehicles, where the company is the registered keeper.

Implications for Tesla’s Operations and EV Leasing

The convictions underscore challenges in Tesla’s UK leasing operations, where rapid growth in fleet size may strain administrative systems. With Tesla dominating EV sales, more leased vehicles mean more potential police requests. Failures allow alleged offenders to evade justice, potentially keeping dangerous drivers on the roads, as noted in reports. This is particularly relevant as Tesla advances autonomous features like Full Self-Driving, where law enforcement cooperation is crucial for safety and regulatory trust.

Financially, £20,686 is minor for Tesla, but reputational damage could affect lessee confidence. Nearly 4,000 similar convictions occurred across England and Wales recently, with fines from £1 to £1,000, indicating this is not isolated to Tesla but amplified by its scale. Prosecutors continue enforcement, with one case pending sentencing.

Tesla’s Defense and Broader Context

In defenses, Tesla claimed internal processes were followed, such as postal notifications to police, but courts consistently ruled against them. No official comment from Tesla has been reported despite media outreach. This fits a pattern of regulatory friction for Elon Musk-led firms, though specifics here tie to paperwork rather than core vehicle tech.

For EV lessors, this raises questions: Are digital-heavy firms like Tesla underprepared for analog police processes? UK law mandates timely responses, and repeated failures suggest process gaps. Unanswered: Will Tesla overhaul its UK compliance team or systems? Details on internal reforms remain unconfirmed.

Comparison with Competitors

Unlike Tesla, traditional lessors like LeasePlan or Arval rarely face such a volume of convictions, per available reports, likely due to established compliance teams. Rivian and Polestar, smaller in the UK leasing, report no similar issues. Tesla’s scale—45,513 registrations—amplifies exposure, but competitors’ lower profiles mean fewer incidents surface. Tesla’s fines equate to about $28,164 USD, dwarfed by its revenue but signaling operational risks others avoid.

| Company | UK EV Registrations (Past Year) | Reported Police ID Convictions | Total Fines |

|---|---|---|---|

| Tesla | 45,513 | 18 | £20,686 |

| BMW (i-series) | ~20,000 (est.) | None reported | N/A |

| Hyundai/Kia | ~35,000 combined | None reported | N/A |

Verdict

Tesla Financial Services’ 18 convictions for failing to ID drivers reveal compliance weaknesses in its UK leasing arm, costing £20,686 but risking bigger trust erosion among EV buyers. This suits Tesla owners aware of its market lead, yet frustrated by opaque violation handling; lessees should confirm contract terms on police requests. Until Tesla confirms fixes, it lags competitors in regulatory responsiveness—watch for appeals or reforms.