Canada’s dramatic tariff reduction on Chinese electric vehicles has handed Lotus Technology a competitive lifeline, slashing the Eletre’s price by approximately 50% and positioning the high-performance SUV to challenge established luxury EV makers in North America. The policy shift, announced January 16 by Prime Minister Mark Carney, reduces import duties from a punitive 100% to just 6.1% for up to 49,000 Chinese EVs annually—a move that transforms the Eletre from a niche ultra-premium offering into a genuine market contender.

The Tariff Deal: Context and Scale

Canada’s new trade agreement with China allows 49,000 Chinese-made electric vehicles to enter the country annually at the preferential 6.1% tariff rate, with the quota expected to grow to roughly 70,000 vehicles within five years. In exchange, China has agreed to reduce duties on Canadian canola exports to approximately 15% from over 80%. While 49,000 units represent only about 2.5% of Canada’s 1.9 million annual vehicle sales, the agreement carries significant implications for the premium EV segment where Lotus operates.

The deal stipulates that over 50% of the 49,000 annual imports must be affordable models priced below CAD$35,000 (USD$25,000), but it explicitly permits premium vehicles—a provision that directly benefits Lotus. The company has already completed North American homologation for the Eletre in 2024, giving it a substantial head start over competitors now seeking Canadian market access under the new regime.

Eletre Pricing: Before and After

| Model Variant | Previous Price (CAD) | Projected Price (CAD) | Projected Price (USD) |

|---|---|---|---|

| Eletre Standard | $126,800 | ~$63,400 | ~$45,650 |

| Eletre R | $178,500 | ~$89,250 | ~$64,300 |

| Eletre Carbon | $313,500 | ~$156,750 | ~$112,850 |

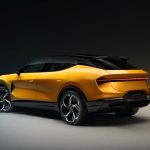

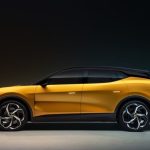

The Eletre Carbon—currently the only variant listed on Lotus’s Canadian configurator—carries a 905-horsepower dual-motor powertrain, accelerates from 0-60 mph in under three seconds, and delivers an estimated 280-mile range from its 109-kilowatt-hour battery. At its projected CAD$156,750 price point, it would undercut the Lamborghini Urus (CAD$305,000) while remaining positioned above the Porsche Cayenne GTS (CAD$134,800).

Market Positioning and Competitive Advantage

Lotus claims to be the only Chinese-made EV manufacturer currently selling vehicles above the USD$80,000 price segment in North America, a distinction that positions the company uniquely within the tariff agreement’s premium vehicle allowance. The company operates six authorized dealerships across Canada and maintains a global retail network of 210 stores across 61 countries, providing established infrastructure to capitalize on the tariff benefits.

If Lotus reintroduces the entry-level Eletre at its projected CAD$63,400 price, it would compete directly with Tesla’s Model Y while offering substantially higher performance credentials—905 horsepower versus the Model Y’s maximum 450 horsepower—and a more upscale interior featuring dual 12.6-inch displays for driver and passenger, a 15.1-inch main screen, and a 9-inch rear passenger display.

CEO Qingfeng Feng stated that Canada “has always been a strategically vital market” for Lotus and that the company would “enhance investment in Canada to explore any potential tactical advantages” while pursuing “growth in a disciplined manner that aligns with market development and creates sustainable value.” Lotus projects wholesale deliveries to achieve “exponential growth” under the revised pricing strategy.

Broader Market Implications

Lotus is the first Chinese EV manufacturer to publicly detail how it will capitalize on the trade agreement. However, other Chinese automakers are expected to announce pricing adjustments in the coming weeks and months. Bloomberg reported that Chinese-made Tesla, Volvo, and Polestar vehicles will also benefit from the reduced tariffs, while BYD and Nio’s Firefly brand are exploring Canadian market entry possibilities.

The agreement represents a significant shift in Canada’s EV trade policy and signals openness to Chinese automotive technology at a time when North American protectionism has dominated recent trade discussions. The deal’s emphasis on affordable vehicles—requiring over 50% of imports to be priced below CAD$35,000—suggests Canada’s intent to increase EV accessibility, while the premium vehicle allowance creates opportunities for luxury brands like Lotus.

Comparison with Competitors

| Vehicle | Horsepower | 0-60 Time | Range | Canadian Price (Projected/Current) |

|---|---|---|---|---|

| Lotus Eletre Carbon | 905 hp | Under 3 sec | 280 miles | ~CAD$156,750 |

| Tesla Model Y (Plaid) | 450 hp | 2.1 sec | 260 miles | CAD$89,990 |

| Porsche Cayenne GTS | 541 hp | 3.9 sec | N/A (ICE) | CAD$134,800 |

| Lamborghini Urus | 657 hp | 3.6 sec | N/A (ICE) | CAD$305,000 |

The Eletre Carbon’s projected pricing places it between the Porsche Cayenne GTS and Lamborghini Urus, offering performance metrics that exceed both while delivering full electric capability. However, the Tesla Model Y Plaid remains substantially cheaper at CAD$89,990, though with lower horsepower and comparable range.

Unanswered Questions and Market Uncertainties

Several critical questions remain unresolved. First, Lotus has not confirmed whether it will actually reintroduce the entry-level Eletre at the projected CAD$63,400 price or maintain focus on the premium Carbon variant. Second, the company has not specified a timeline for implementing the price reductions or whether they will apply retroactively to existing orders. Third, the sustainability of the tariff agreement itself remains uncertain—future deterioration in Canada-China trade relations could jeopardize the preferential 6.1% rate.

Additionally, the 49,000-unit annual cap may constrain Lotus’s growth ambitions if demand exceeds the quota allocation, and the company has not disclosed how it will prioritize Canadian deliveries against global demand.

Verdict

The tariff reduction fundamentally reshapes the Eletre’s Canadian market proposition, transforming it from a niche ultra-premium vehicle into a competitive luxury performance SUV. For buyers prioritizing acceleration, interior technology, and distinctive positioning over Tesla’s market dominance, the projected CAD$156,750 Eletre Carbon price represents genuine value—particularly if Lotus reintroduces lower-priced variants. However, the deal’s long-term viability depends on stable Canada-China trade relations and Lotus’s commitment to sustained Canadian market investment. This opportunity is primarily for performance-focused luxury buyers seeking an alternative to established German and Italian brands, though the entry-level Eletre—if reintroduced—could appeal to premium EV buyers seeking maximum horsepower at mid-luxury pricing.