General Motors boosted its US EV sales by 48% to 169,887 units in 2025, seizing market share as total EV sales dipped 2% to 1.28 million units following the end of federal tax credits. This growth, driven by Chevrolet and Cadillac models, positions GM as the top non-Tesla player in a maturing market where competition intensifies, and buyer preferences shift toward value and variety.

EV buyers now prioritize affordability and proven range over early hype, making GM’s diverse lineup a key factor for readers eyeing alternatives to Tesla dominance.

Background: GM’s Rise in a Cooling US EV Market

General Motors, long a powerhouse in traditional vehicles, has aggressively expanded its EV portfolio to capture shifting consumer demand. In 2025, the US EV market contracted for the first time in years, with sales falling 2% from 1.3 million units in 2024 to approximately 1.28 million units. Kelley Blue Book data confirms 1,275,714 battery-electric vehicles sold, a precise 2% drop from 1,301,441 in 2024.

The decline stemmed from the expiration of the $7,500 federal EV tax credit at the end of September 2025, triggering a Q4 sales plunge of 36% to 234,171 units from 365,830 in Q4 2024. Despite a Q3 peak of 10.5% EV market share (437,487 units), Q4 share fell to 5.8%, reflecting incentive-driven rushes followed by hesitation. Overall, EVs held 7.8% of total US new vehicle sales, down slightly from 8.1% in 2024.

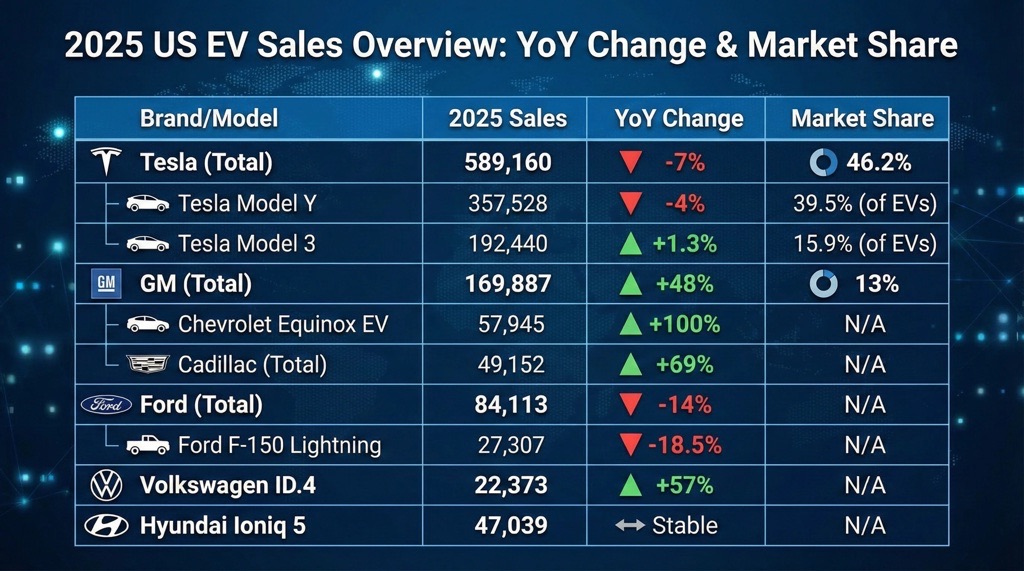

GM capitalized on this, achieving 169,887 EV sales—a 48% increase from 2024—making it the second-largest EV seller behind Tesla. Chevrolet’s Equinox EV doubled to 57,945 units, while Cadillac surged 69% to 49,152 units; combined Chevrolet sales reached 96,951. This performance underscores GM’s market position as a diversified challenger in a segment where Tesla’s share slipped from 48.7% to 46.2%.

Key Specifications: Top US EV Performers in 2025

| Brand/Model | 2025 Sales | YoY Change | Market Share |

|---|---|---|---|

| Tesla (Total) | 589,160 | -7% | 46.2% |

| Tesla Model Y | 357,528 | -4% | 39.5% (of EVs) |

| Tesla Model 3 | 192,440 | +1.3% | 15.9% (of EVs) |

| GM (Total) | 169,887 | +48% | 13% |

| Chevrolet Equinox EV | 57,945 | +100% | N/A |

| Cadillac (Total) | 49,152 | +69% | N/A |

| Ford (Total) | 84,113 | -14% | N/A |

| Ford F-150 Lightning | 27,307 | -18.5% | N/A |

| Volkswagen ID.4 | 22,373 | +57% | N/A |

| Hyundai Ioniq 5 | 47,039 | Stable | N/A |

Note: Sales figures primarily from ArenaEV and cross-verified with Kelley Blue Book via multiple sources. Market shares approximate for the US EV segment.

Analysis: What Drove GM’s Gains and Market Shifts

Tax Credit Expiration Reshapes Demand

The end of the federal tax credit created a boom-bust cycle: Q3 2025 saw a record 10.5% EV penetration as buyers rushed for incentives, but Q4 collapsed 46% quarter-over-quarter. This exposed reliance on subsidies; without them, high prices deterred mass adoption. GM’s success highlights models like the Equinox EV offering competitive pricing post-incentives, appealing to value-conscious families.

Tesla’s Slip Opens Doors for Challengers

Tesla sold 589,160 units but lost ground, with Model Y down 4% amid production pauses for refreshes. Model 3 grew modestly to 192,440, but combined, they held over 50% market share. Political noise around CEO Elon Musk did not derail core demand, yet competitors like GM gained by targeting non-Tesla buyers seeking variety.

Model Diversity Fuels Non-Tesla Growth

GM’s broad lineup—Equinox EV, Blazer EV (20,825 units), and Cadillac offerings—drove 48% growth, proving variety attracts hesitant buyers. Volkswagen’s ID.4 jumped 57% to 22,373; Honda Prologue hit 39,194; Hyundai Ioniq 5 held at 47,039. Failures like Ford (-14%) and Kia (-40%) show feature gaps and pricing matters more than availability.

Competitor Comparison

GM (169,887 units, +48%) outpaced Ford (84,113, -14%), whose F-150 Lightning fell 18.5% amid truck buyer reluctance. Volkswagen (ID.4-led +57%) and Hyundai (stable Ioniq 5) showed targeted gains but trailed GM’s volume. Tesla remains untouchable at 589,160, yet its 7% drop cedes 2.5 share points to risers like GM.

| Brand | 2025 Sales | YoY % | Strength | Weakness |

|---|---|---|---|---|

| GM | 169,887 | +48 | Diverse affordable models | Still behind Tesla volume |

| Ford | 84,113 | -14 | Truck heritage | Sales decline, high prices |

| VW | ID.4: 22,373 | +57 | Model-specific surge | Low overall volume |

| Tesla | 589,160 | -7 | Dominant share | Declining growth |

Verdict

Verdict

GM emerges as the 2025 standout, with 48% growth proving strategic model launches and pricing beat Tesla’s scale in a subsidy-free era—this is for practical buyers wanting Chevy affordability or Cadillac luxury without Tesla’s ecosystem lock-in. Ford and Kia lag, signaling risks for laggards; unanswered questions linger on 2026 pricing wars and charging infrastructure. Watch GM for sustained No. 2 status if it maintains momentum.