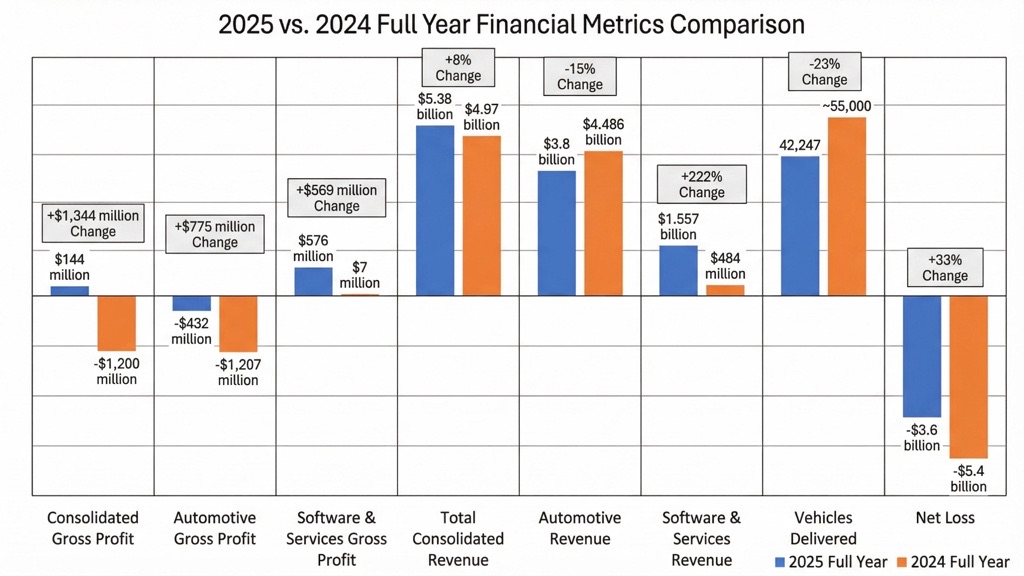

Rivian achieved its first full-year consolidated gross profit of $144 million in 2025, marking a dramatic $1.3 billion swing from a $1.2 billion loss in 2024. The milestone signals the Irvine-based EV manufacturer has found a path toward sustainability after years of mounting losses, though the company’s automotive division remains unprofitable.

The turnaround was driven primarily by explosive growth in software and services revenue, which surged 222% year-over-year to $1.557 billion, generating $576 million in gross profit. This performance overshadowed continued weakness in core vehicle sales, where automotive gross profit remained negative at -$432 million despite improving from -$1.207 billion in 2024.

The Software Lifeline

Rivian’s financial recovery rests on an unexpected pillar: software development services, not electric vehicles. The company’s joint venture with Volkswagen Group provided the primary catalyst, delivering vehicle electrical architecture and software development services that generated $447 million in Q4 2025 alone—a 109% increase from $214 million in Q4 2024.

Beyond the VW partnership, Rivian expanded revenue streams through vehicle remarketing (trade-in sales) and repair and maintenance services. These ancillary businesses contributed meaningfully to the $1.557 billion software and services total for 2025, compared to just $484 million in 2024.

“Strong software and services performance, higher average selling prices, and reductions in cost per vehicle” drove the gross profit improvement, according to Rivian’s earnings release. The company’s total consolidated revenue reached $5.38 billion in 2025, up 8% from $4.97 billion in 2024, though automotive revenue declined 15% to $3.8 billion.

Automotive Division Still Bleeding

While the headline gross profit figure appears positive, Rivian’s core business—manufacturing and selling electric vehicles—continues to lose money. Automotive gross profit of -$432 million in 2025 reflects the harsh reality of EV market conditions: regulatory credit sales plummeted $134 million year-over-year, federal tax credits expired, and vehicle deliveries fell short of 2024 levels.

The company delivered 42,247 vehicles in 2025, producing 42,284 units. Q4 2025 automotive revenues dropped 45% to $839 million, primarily due to a $270 million collapse in regulatory credit sales and lower average selling prices driven by a higher mix of EDV (commercial delivery vehicle) deliveries.

Rivian’s net loss for 2025 totaled $3.6 billion, though the company projects an adjusted net loss of $1.8 billion to $2.1 billion for 2026—a significant improvement trajectory. The company laid off approximately 600 employees (4% of the workforce) in October 2025 to reduce costs.

2026 Outlook: R2 Ramp and Delivery Expansion

Rivian’s 2026 guidance reflects cautious optimism centered on the upcoming R2 compact SUV. The company targets 62,000 to 67,000 vehicle deliveries in 2026, up from 42,247 in 2025. Capital expenditures are projected between $1.95 billion and $2.05 billion to support the R2 production ramp, with customer deliveries expected in Q2 2026.

The R2 represents Rivian’s bet on mass-market appeal after years focused on premium R1T trucks and R1S SUVs. Early reviews of pre-production R2 units have been “outstanding,” according to the company’s earnings announcement, though independent delivery data remains limited.

Key Specifications and Financial Metrics

| Metric | 2025 Full Year | 2024 Full Year | Change |

|---|---|---|---|

| Consolidated Gross Profit | $144 million | -$1,200 million | +$1,344 million |

| Automotive Gross Profit | -$432 million | -$1,207 million | +$775 million |

| Software & Services Gross Profit | $576 million | $7 million | +$569 million |

| Total Consolidated Revenue | $5.38 billion | $4.97 billion | +8% |

| Automotive Revenue | $3.8 billion | $4.486 billion | -15% |

| Software & Services Revenue | $1.557 billion | $484 million | +222% |

| Vehicles Delivered | 42,247 | ~55,000 | -23% |

| Net Loss | -$3.6 billion | -$5.4 billion | +33% |

Market Context and Stock Performance

Rivian’s earnings announcement triggered a 27% surge in its stock on February 13, 2026, as investors rewarded the company for an unexpected profitability milestone and an improved cost structure. The rally reflected relief that Rivian has stabilized after years of investor skepticism about its path to viability.

The results position Rivian as an outlier in a struggling EV market where competitors face headwinds from subsidy reductions and cooling consumer demand. However, analysts note the company remains dependent on software revenue from its Volkswagen partnership. This revenue stream could face pressure if the joint venture underperforms or if VW’s own EV strategy shifts.

Critical Questions Ahead

Several uncertainties cloud Rivian’s recovery narrative. First, the sustainability of software revenue growth depends heavily on the Volkswagen partnership’s continued expansion—a relationship that could be renegotiated or restructured. Second, R2 production ramp carries execution risk; any delays or quality issues could derail 2026 delivery targets of 62,000-67,000 units. Third, automotive gross profit remains deeply negative, meaning vehicle sales alone cannot yet support the business—the company must continue scaling software revenue while improving vehicle profitability.

Additionally, Rivian’s adjusted EBITDA guidance of -$1.8 billion to -$2.1 billion for 2026 indicates the company will continue burning substantial cash despite gross profit improvements. Long-term profitability on a net income basis remains years away.

Verdict

Rivian’s 2025 gross profit achievement represents genuine operational progress, not accounting sleight-of-hand. The company has demonstrably reduced per-vehicle costs, improved pricing on higher-mix R1 deliveries, and built a meaningful software business. However, investors should recognize this milestone for what it is: a waypoint, not a destination. Rivian’s core automotive business remains unprofitable, and the company’s financial health depends on software revenue streams that may not scale indefinitely. The R2 launch in Q2 2026 is the critical test—if Rivian can profitably manufacture and deliver a mass-market EV at scale, the 2025 turnaround becomes a genuine inflection point. If R2 struggles, the software revenue advantage may prove insufficient to offset mounting losses. For EV enthusiasts, Rivian’s recovery is encouraging; for investors, it warrants cautious optimism pending R2 execution.