GM Doubles Down on EVs While Taking $6 Billion Charge

General Motors CEO Mary Barra reaffirmed the company’s long-term commitment to electric vehicles as its core strategy, even as GM takes a $6 billion charge to restructure EV investments following a dramatic 43% quarterly sales decline in late 2025. Speaking at the Automotive Press Association in Detroit this week, Barra acknowledged the immediate headwinds from policy rollbacks and market disruption while maintaining that EVs remain GM’s “north star” for the future.

The mixed signals reflect an automotive industry in flux. GM’s EV sales fell sharply in Q4 2025 to 25,219 units following the expiration of the federal $7,500 tax credit, yet the company still sold 169,887 EVs for the full year—a 48% increase from 2024 and the second-largest volume behind Tesla. This paradox defines GM’s current position: short-term pain masking long-term conviction.

The Policy Whiplash That Changed Everything

Barra identified the elimination of federal EV incentives as the single most disruptive factor in 2025, more damaging than tariff concerns that dominated industry discussions in 2024. The loss of the $7,500 tax credit created an immediate pricing cliff that consumers couldn’t ignore, collapsing demand precisely when GM had ramped production to meet earlier forecasts.

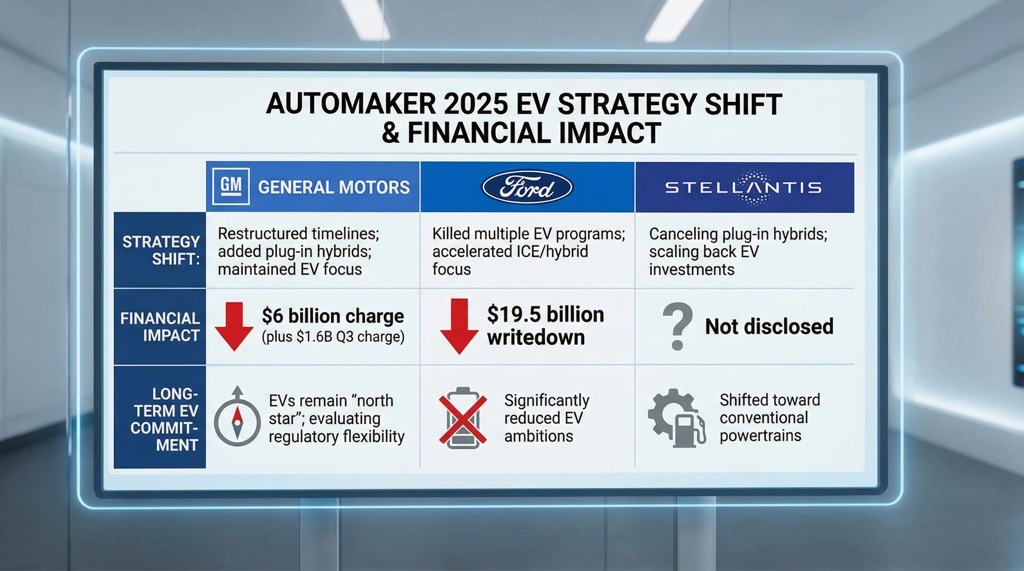

Yet Barra expressed no regret about GM’s earlier EV investments, arguing they were justified based on available information at the time. This stance distinguishes GM from competitors like Ford, which took a $19.5 billion writedown and killed multiple EV programs, or Stellantis, which is quietly abandoning plug-in hybrids entirely. GM’s $6 billion charge, while substantial, represents a more measured retreat than competitors have executed.

The CEO emphasized that regulatory uncertainty extends beyond 2025. “I’m a little surprised at some [automakers] that are really pulling away very quickly, because we don’t know what will be in ’29, ’30, ’32,” Barra said, signaling that GM is hedging against potential regulatory reversals after the 2028 presidential election. This strategic flexibility—maintaining EV capability while adjusting timelines—may prove prescient if future administrations reinstate emissions standards or incentives.

Tariffs, Cost Controls, and the Path Forward

While policy changes dominated 2025, Barra revealed that GM’s tariff mitigation strategy proved more effective than initially feared. When tariff risks emerged in 2024, GM executed what she called “no-regret moves” to limit exposure. By May 2025, GM estimated tariffs could cost approximately $5 billion, but internal measures offset roughly 30% of that impact.

Those mitigation steps included increasing U.S.-based vehicle and component production, executing $2 billion in cost reductions, and maintaining strict pricing discipline. These actions helped stabilize operations despite the volatile policy environment, suggesting GM’s operational flexibility may be stronger than headline numbers indicate.

Looking ahead, GM plans to prioritize software development and advanced driver-assistance systems, including new eyes-free technology targeted for 2028. The company is also evaluating both plug-in hybrids and conventional hybrids for specific market segments, though Barra reiterated that EVs remain the primary investment focus. GM confirmed plans to introduce plug-in hybrids in the U.S., though specific models and timing remain unconfirmed beyond Barra’s previous statement that they would arrive in 2027.

The EV Buyer Loyalty Factor

A critical element of Barra’s conviction centers on EV buyer behavior. She emphasized that EV customers tend to be repeat buyers, reinforcing GM’s belief that long-term adoption remains on track despite near-term slowdowns. This insight suggests GM views the 2025 collapse as temporary demand destruction rather than fundamental market rejection of electrification.

The data partially support this view. While Q4 2025 saw a sharp drop, GM’s full-year EV sales of 169,887 units represented nearly 50% growth from 2024, indicating sustained underlying demand despite the tax credit cliff. If EV buyers do exhibit higher loyalty and repeat purchase rates, GM’s current EV customer base could provide a foundation for recovery once pricing stabilizes or incentives return.

Comparison: GM’s Measured Approach vs. Competitor Retreats

| Automaker | 2025 EV Strategy Shift | Financial Impact | Long-Term EV Commitment |

|---|---|---|---|

| General Motors | Restructured timelines; added plug-in hybrids; maintained EV focus | $6 billion charge (plus $1.6B Q3 charge) | EVs remain “north star”; evaluating regulatory flexibility |

| Ford | Killed multiple EV programs; accelerated ICE/hybrid focus | $19.5 billion writedown | Significantly reduced EV ambitions |

| Stellantis | Canceling plug-in hybrids; scaling back EV investments | Not disclosed | Shifted toward conventional powertrains |

Unanswered Questions and Risks

Despite Barra’s confidence, critical questions remain unanswered. GM has not specified which vehicle segments will receive plug-in hybrids or provided updated timelines beyond the 2027 target mentioned in mid-2024. The company also hasn’t detailed how it will price EVs competitively without federal incentives, or whether lower pricing alone can restore demand to pre-2025 levels.

Additionally, Barra acknowledged that plug-in hybrid owners often fail to charge their vehicles, undermining their environmental and regulatory benefits. This raises questions about whether PHEVs represent a genuine strategic pivot or merely a hedge against regulatory uncertainty.

The broader risk is that GM’s “wait and see” approach to regulations could leave it unprepared if the policy environment shifts more dramatically than anticipated. Competitors pulling back aggressively may find cost advantages if EV demand remains suppressed, while GM carries higher EV-related infrastructure and development costs.

Verdict

Mary Barra’s message is clear: GM is not abandoning electrification, but it is recalibrating timelines and adding flexibility through plug-in hybrids and conventional hybrids. The $6 billion charge reflects a realistic acknowledgment of near-term market disruption, not strategic surrender. For investors and dealers, this means GM is positioning itself to capitalize on EV adoption whenever policy and market conditions align—whether that occurs in 2027, 2029, or beyond. The company’s measured approach, combined with its second-place EV sales position and strong truck/SUV heritage, positions it better than competitors who have executed more dramatic retreats. However, the strategy depends entirely on EV demand eventually recovering and regulatory tailwinds returning. If the current anti-EV policy environment persists through 2028 and beyond, GM’s continued EV investments could become a competitive liability rather than an asset.