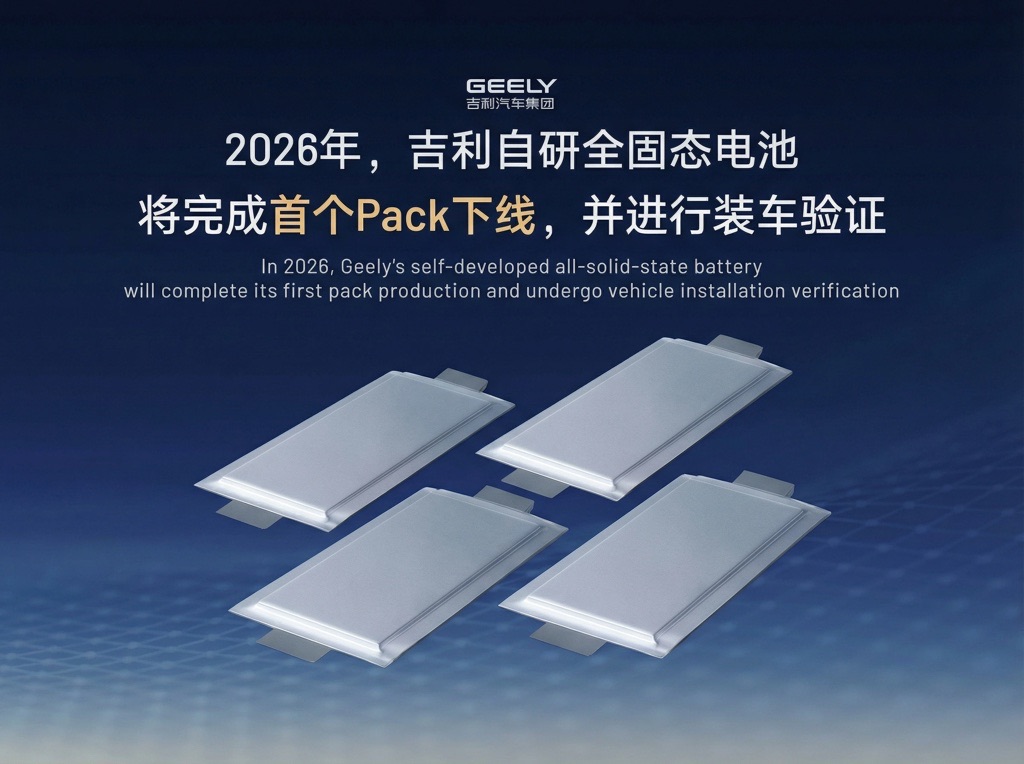

Geely Auto will complete production of its first all-solid-state battery pack in 2026, marking a pivotal shift as Chinese automakers lead the transition to this technology with energy densities up to 400 Wh/kg for ranges exceeding 1000 km. This development promises safer, faster-charging EVs, directly addressing range anxiety and cold-weather performance limitations that have hindered mass adoption. EV buyers and fleet operators should monitor 2026 closely, as real-world vehicle testing begins this year, potentially accelerating global EV competitiveness.

Background: Geely’s Rise and the Global Solid-State Race

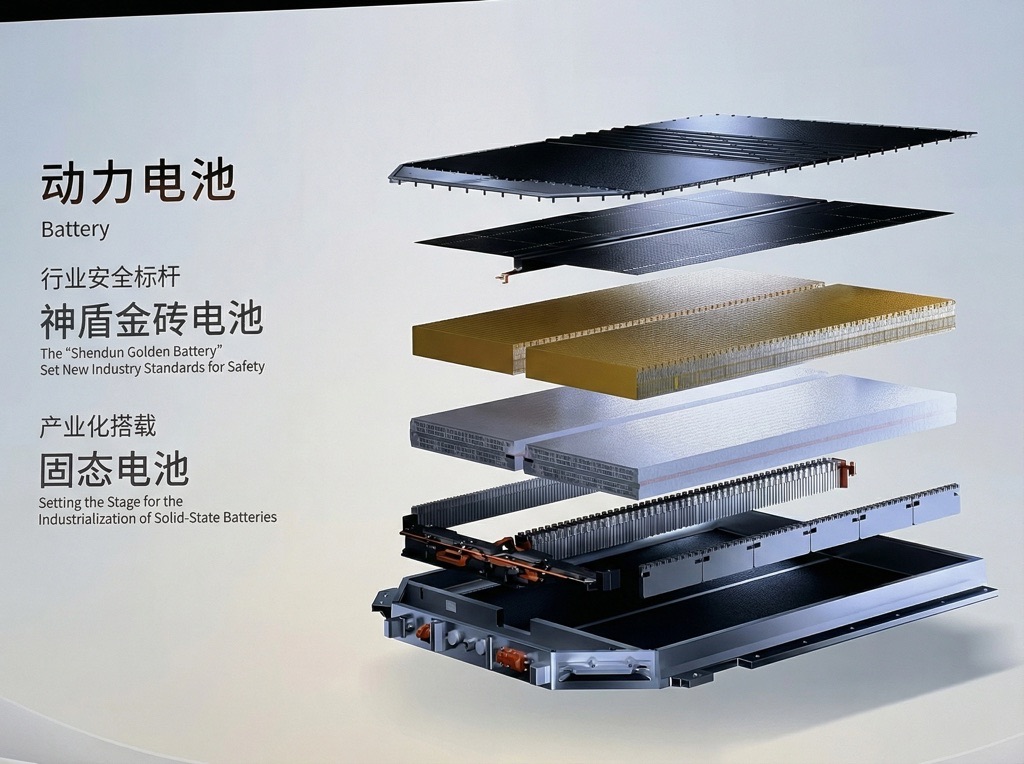

Geely Auto, a major Chinese automaker owning premium brands like Volvo and Polestar, announced at its Holding Group’s five-year strategy event that it will finish its first in-house all-solid-state battery pack in 2026, followed by vehicle installation verification. This positions Geely ahead of giants like CATL and BYD, who target small-scale integration only in 2027. Geely’s push aligns with China’s aggressive EV innovation, where companies like Dongfeng and Chery are also advancing rapidly.

The solid-state battery replaces liquid electrolytes with solid ones, offering higher energy density, improved safety (no flammable liquids), and better performance in extreme temperatures. Globally, 2026 emerges as the inflection point: U.S. firms like Factorial Energy partner with Mercedes and Stellantis for test fleets, QuantumScape opens a Volkswagen-bound pilot line in February, and Europe’s Blue Solutions expands from buses (over 600 million km driven) to passenger cars. ProLogium breaks ground on a French gigafactory, though production starts in 2028.

Key Specifications of Leading 2026 Solid-State Batteries

| Company | Battery Type | Energy Density | Key Milestones | Range Potential |

|---|---|---|---|---|

| Geely | All-solid-state | Details not yet confirmed | Production & vehicle testing in 2026 | Not specified |

| Dongfeng | Solid-state | 350 Wh/kg | Cold-weather testing Jan 2026; mass production Sep 2026 | 1000 km |

| Svolt | Semi-solid-state (Gen 2) | 400 Wh/kg | Completion in 2026 | Not specified |

| Chery (Exeed Liefeng) | Rhino S solid-state | Near 600 Wh/kg | Fleet launch 2026; mass production 2027 | 1500 km |

| FAW Hongqi | Solid-state | Details not yet confirmed | Prototype rollout Dec 2025 | Not specified |

Geely complements its solid-state efforts with a new lithium-manganese-iron-phosphate (LMFP) battery, delivering 15% higher energy density than prior versions without added weight.

Analysis: Technical Promises and Manufacturing Hurdles

Solid-state batteries target 350-600 Wh/kg densities, doubling current lithium-ion packs (around 250-300 Wh/kg) for 1000+ km ranges on realistic cycles. Dongfeng’s 350 Wh/kg pack, tested in extreme cold since January 14, 2026, proves viability where lithium-ion falters. Chery’s Rhino S battery maintains performance to -30°C, paired with an 800V architecture and 30,000 rpm motor for sub-3-second 0-100 km/h in the Exeed Liefeng.

Safety gains are substantial: solid electrolytes reduce fire risk and enable faster charging. However, scaling remains the challenge. Geely’s pack production is a first for all-solid-state integration, but mass affordability is unclear—CATL and BYD’s 2027 caution highlights cost and yield issues. Recycling poses another hurdle; Blue Solutions is piloting lines for this in 2026, as processes differ from lithium-ion.

Analysis: Regional Strategies and Competitive Dynamics

China dominates with integrated automaker-battery development: Geely, Dongfeng, Chery, Svolt, and FAW Hongqi prioritize speed over perfection. U.S. players like Factorial (Mercedes demo fleet) and QuantumScape (VW pilot) focus on partnerships, while Europe builds infrastructure—Blue Solutions leverages bus experience, ProLogium invests in France.

Unanswered questions persist: exact Geely densities, pricing, and degradation rates over 100,000+ km. Real-world data from 2026 fleets will be critical; Chery’s ride-hailing rollout offers early insights. Supply chain strains could delay non-Chinese efforts if raw materials like sulfides prove scarce.

Comparison: Solid-State Leaders vs. Conservative Giants

| Player | 2026 Milestone | Energy Density | Timeline vs. Competitors |

|---|---|---|---|

| Geely/Dongfeng/Chery | Production/testing/fleets | 350-600 Wh/kg | Ahead: Mass push in 2026 |

| QuantumScape (VW) | Pilot line Feb 2026 | Details not yet confirmed | Mass production 2027-2028 |

| Factorial (Mercedes/Stellantis) | Demo fleet | Details not yet confirmed | Pre-commercial |

| CATL/BYD | None | N/A | Small-scale 2027 |

Chinese firms outpace via vertical integration, but Western tech may excel in longevity if pilots succeed.

Verdict

2026 solid-state batteries from Geely and peers represent a credible leap, with verified 350-600 Wh/kg densities enabling 1000-1500 km ranges and cold tolerance that could redefine EVs for long-haul drivers and fleets. Ideal for range-focused consumers in harsh climates, but wait for 2027 mass data before committing—early adopters risk unproven yields. This isn’t hype; it’s engineering progress demanding scrutiny on costs and scalability.