Lucid Motors Rebounds on Saudi Backing and Autonomous Vehicle Momentum

Lucid Motors shares jumped more than 15% on Wednesday following a Cantor Fitzgerald analyst report confirming Saudi Arabia’s Public Investment Fund (PIF) remained committed to supporting the electric vehicle maker, easing investor concerns about long-term funding and signaling potential upside of over 110% from recent lows. The rally marks a significant reversal for a stock that had declined 65% throughout 2025 and 41% over the previous three months, with the company’s market capitalization compressed to around $3 billion—a stark contrast to the $9 billion PIF has invested over eight years.

PIF Commitment Reshapes Valuation Outlook

Cantor Fitzgerald analyst Andres Sheppard reported that his team had recently met directly with PIF representatives, increasing confidence in the fund’s continued backing. The analyst maintained a $21 price target, implying upside of roughly 116% from the prior session’s close. This direct engagement proved critical: uncertainty around PIF’s long-term support had previously weighed heavily on Lucid’s valuation, creating a funding overhang that depressed investor sentiment.

The PIF currently owns more than 50% of Lucid, making its commitment essential to the company’s survival and growth trajectory. Sheppard’s note specifically addressed this uncertainty, noting that confirmation of continued backing could help stabilize the stock and attract institutional investors who had grown wary of the company’s financial runway.

Production Momentum and Financial Turnaround

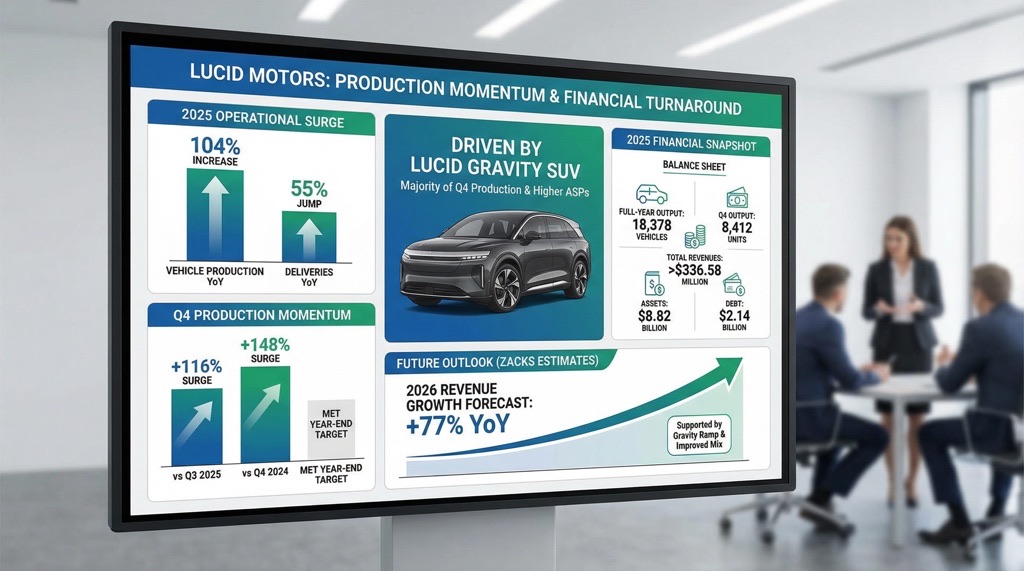

The timing of the Cantor Fitzgerald report coincided with Lucid’s strongest operational performance in years. The company reported a 104% year-over-year increase in vehicle production for 2025, with deliveries jumping 55%. Fourth-quarter results were particularly impressive: production surged 116% versus Q3 and 148% compared to Q4 2024, allowing Lucid to meet its year-end production target after a sluggish first half.

The Lucid Gravity SUV drove this momentum, becoming the majority of fourth-quarter production and commanding higher average selling prices. Full-year 2025 output reached 18,378 vehicles, with Q4 alone producing 8,412 units. Total revenues for the year exceeded $336.58 million, while assets stood at $8.82 billion against debt of $2.14 billion. Zacks Consensus Estimates project 2026 revenues will grow 77% year-over-year, supported by continued Gravity production ramp and improved model mix.

Autonomous Vehicle Ambitions Reshape Long-Term Narrative

Beyond near-term funding relief, Sheppard highlighted Lucid’s growing autonomous vehicle ambitions as a key driver of future value creation. The company unveiled an autonomous taxi platform at CES earlier in January, with plans to deploy more than 20,000 Lucid Gravity vehicles as robotaxis over the next six years. Initial deployment is expected to begin in late 2026 or early 2027.

Lucid has already secured partnerships in this space: the company received approximately $300 million from Uber Technologies as part of its autonomous taxi program, launched in partnership with autonomous vehicle startup Nuro. Sheppard noted that additional autonomous driving partnerships are likely to be announced throughout 2026, with potential announcements expected at Lucid’s Investor Day scheduled for March 12, 2026.

The robotaxi strategy addresses a critical challenge for Lucid: transitioning from a luxury vehicle manufacturer to a diversified mobility company with multiple revenue streams. Cantor Fitzgerald suggested that progress on autonomy and partnerships could help reshape investor perception as Lucid works to stabilize its core business and scale future revenue.

Market Context and Competitive Position

Lucid’s stock recovery comes after a brutal 2025, during which the company faced intense scrutiny over its path to profitability and funding sustainability. The stock had hit a record low of $9.50 on Tuesday before the Cantor Fitzgerald report lifted shares. The 22% two-day rally (including Thursday’s continued gains) reflects a dramatic shift in investor sentiment, driven by three factors: confirmed PIF support, accelerating production and delivery growth, and credible autonomous vehicle partnerships.

The company also received recognition for innovation: the Lucid Gravity SUV won MotorTrend’s 2026 Best Tech Award for charging innovation, reinforcing its positioning as a technology leader in the EV space. Additionally, Lucid announced plans to commence production in Saudi Arabia by 2026, signaling geographic diversification and deeper integration with its primary financial backer.

CFRA Research updated its perspective on Lucid, moving the company’s rating from Strong Sell to Hold, reflecting renewed investor optimism. This rating upgrade, combined with Cantor Fitzgerald’s bullish stance, suggests growing analyst confidence in the company’s trajectory.

Unanswered Questions and Risks

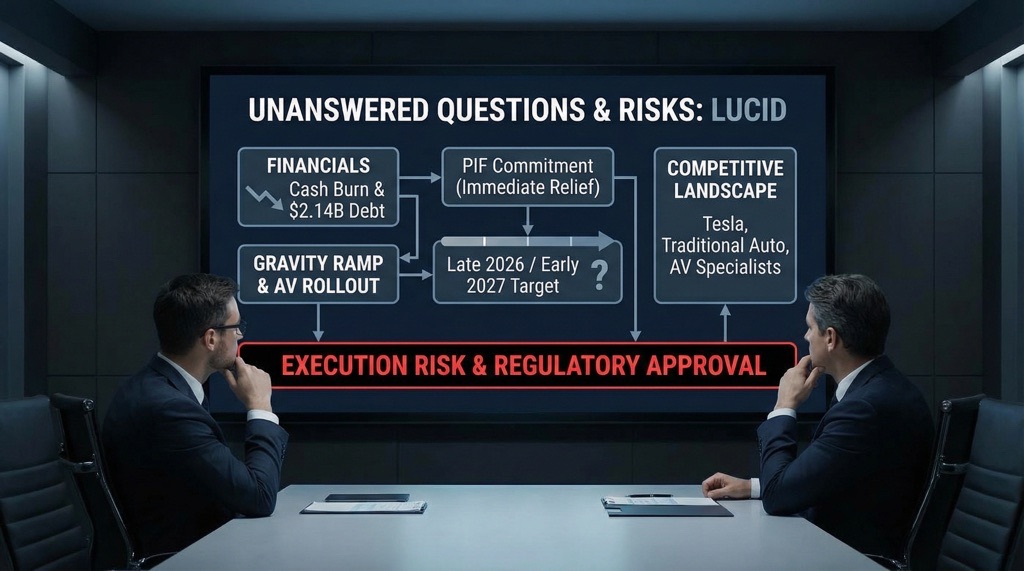

Despite the positive momentum, critical questions remain. While PIF’s commitment eases immediate funding concerns, Lucid has not yet achieved profitability and continues to burn cash. The company’s debt of $2.14 billion requires careful management, and execution risk on the Gravity production ramp and autonomous vehicle rollout remains substantial. The robotaxi deployment timeline—beginning in late 2026 or early 2027—is aggressive and will require flawless execution in both autonomous technology and regulatory approval across multiple jurisdictions.

Additionally, the competitive landscape has intensified. Tesla, traditional automakers, and specialized autonomous vehicle companies are all pursuing robotaxi strategies. Lucid’s success will depend on differentiating its Gravity platform through superior autonomous capabilities, reliability, and cost efficiency.

Verdict

Lucid Motors’ 15% Wednesday rally represents a meaningful inflection point driven by concrete confirmation of Saudi PIF support and accelerating operational momentum. Cantor Fitzgerald’s 116% upside target, while ambitious, reflects genuine progress on production, autonomous vehicles, and strategic partnerships. For investors, the key question is whether Lucid can execute on its 2026 roadmap—particularly the robotaxi deployment and additional partnership announcements—without requiring additional dilutive capital raises. The company is no longer a pure funding story; it’s becoming an execution story. Success requires flawless delivery on Gravity production, autonomous technology validation, and partnership expansion. For traders and long-term investors, the risk-reward profile has shifted meaningfully in Lucid’s favor, but execution risk remains substantial.