For nearly a decade, Tesla dominated the global electric car market, setting growth records unmatched by almost any automaker in history. However, 2025 marks a clear turning point. For the second consecutive year, Tesla’s vehicle deliveries declined — and the company has now lost its position as the world’s largest battery-electric vehicle (BEV) seller.

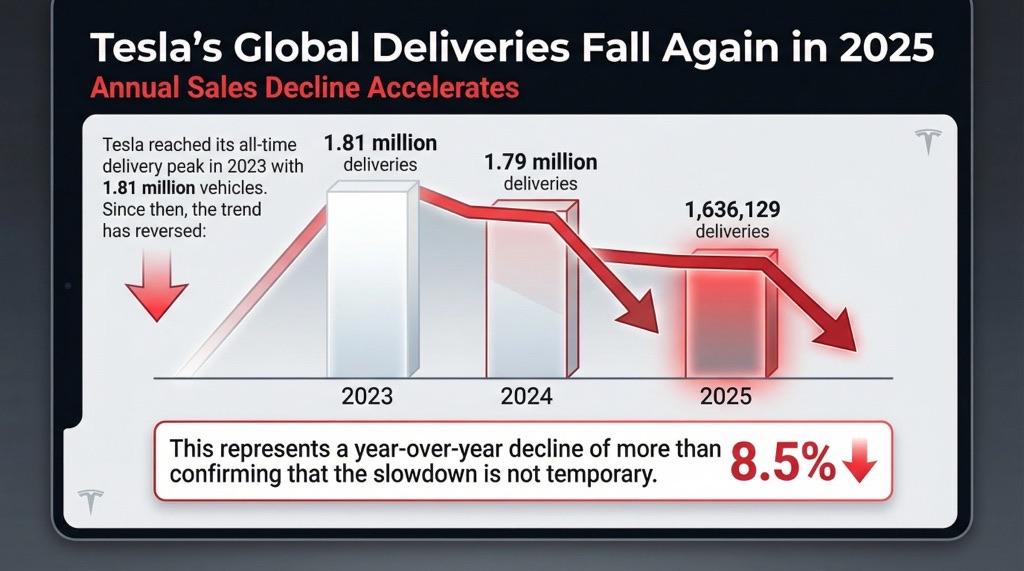

Tesla’s Global Deliveries Fall Again in 2025

Annual Sales Decline Accelerates

Tesla reached its all-time delivery peak in 2023 with 1.81 million vehicles. Since then, the trend has reversed:

-

2023: 1.81 million deliveries

-

2024: 1.79 million deliveries

-

2025: 1,636,129 deliveries

This represents a year-over-year decline of more than 8.5%, confirming that the slowdown is not temporary.

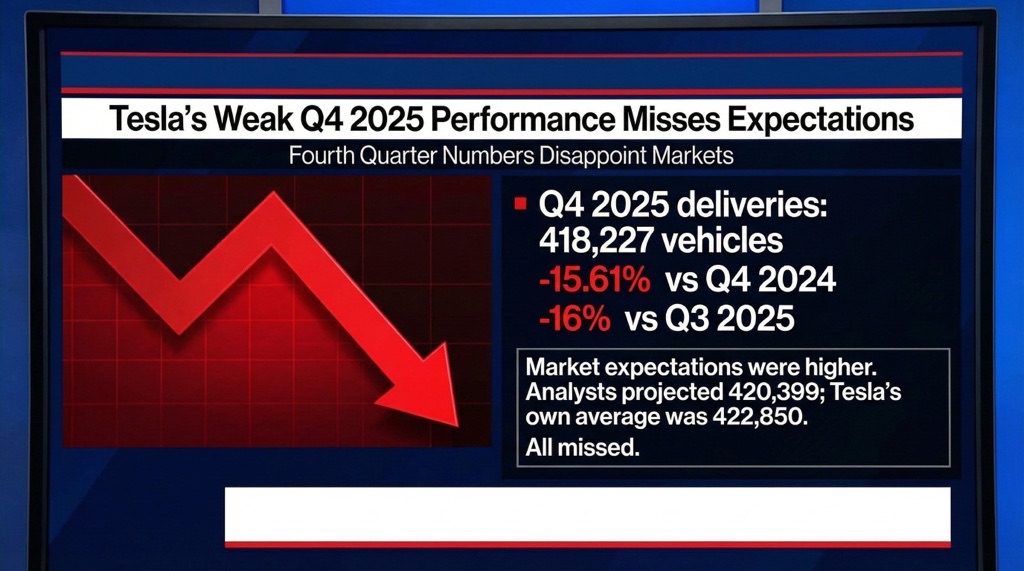

Weak Q4 Performance Misses Expectations

Fourth Quarter Numbers Disappoint Markets

The situation worsened toward the end of the year:

-

Q4 2025 deliveries: 418,227 vehicles

-

–15.61% vs Q4 2024

-

–16% vs Q3 2025

Market expectations were higher. Most analysts projected 420,399 deliveries, while Tesla’s own compiled analyst average stood at 422,850 units. Even against these lowered expectations, Tesla fell short.

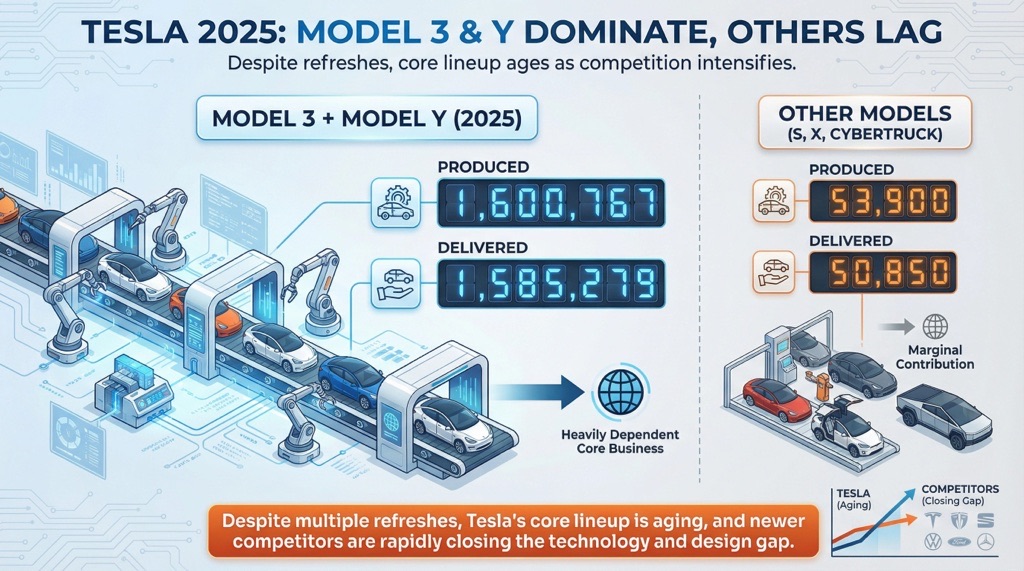

Model 3 and Model Y Still Carry Tesla

Other Models Remain Marginal

Tesla’s business remains heavily dependent on two vehicles:

-

Model 3 + Model Y (2025):

-

Produced: 1,600,767

-

Delivered: 1,585,279

-

-

Other models (Model S, Model X, Cybertruck):

-

Produced: 53,900

-

Delivered: 50,850

-

Despite multiple refreshes, Tesla’s core lineup is aging, and newer competitors are rapidly closing the technology and design gap.

BYD Overtakes Tesla as Global BEV Leader

China’s EV Giant Takes the Crown

The most significant headline from 2025 is that Tesla is no longer the world’s top BEV manufacturer.

BYD delivered:

-

2,256,714 battery-electric vehicles in 2025

-

+28% year-over-year growth

That’s over 600,000 more BEVs than Tesla sold.

While BYD’s plug-in hybrid sales dipped slightly to 2,288,709 units, its dominance in pure electric vehicles is now unquestionable.

Europe and China: Trouble on Both Fronts

Europe Turns Away From Tesla

Tesla’s problems are especially visible in Europe:

-

–28% drop in new registrations during the first 11 months of 2025

-

Brand perception weakened in several countries

Analysts increasingly point to the political activities of Elon Musk as a factor affecting consumer sentiment.

Meanwhile, BYD’s European sales surged by 276% over the same period.

China: Fierce Local Competition

In China, Tesla faces relentless pressure from domestic brands:

-

–7% sales decline through November

-

Local EV makers offering newer tech at lower prices

-

Faster model refresh cycles and aggressive pricing strategies

Aging Lineup and Fading Incentives

Price Cuts Are Losing Effectiveness

Tesla’s reliance on the Model 3 and Model Y is becoming a liability:

-

Recent refreshes failed to reignite demand

-

No truly new mass-market models launched

-

Price cuts and incentives are being reduced, especially in the US

In a fast-moving EV market, novelty and innovation matter, and Tesla’s lineup currently lacks both.

One Bright Spot: Energy Storage Business

Record Deployment, Limited Impact

Tesla did post a positive milestone outside automotive:

-

14.2 GWh of energy storage deployed in Q4 2025 (record)

However, energy storage revenues are not yet large enough to offset declining vehicle margins. Tesla is expected to close 2025 with lower revenue and reduced earnings compared to 2024.

Is Tesla Still a Car Company?

Musk Shifts the Narrative

Elon Musk has increasingly framed Tesla as an AI and robotics company, emphasizing:

-

Autonomous driving

-

Humanoid robots

-

Artificial intelligence platforms

For believers in that vision, falling car sales may seem secondary. For everyone else, the numbers tell a clear story: Tesla’s dominance in electric cars is no longer guaranteed.

Big Picture: A Historic Shift in the EV Market

Tesla’s 2025 results mark the end of an era. The company that once defined the global EV industry is now:

-

Losing market share

-

Falling behind faster-moving rivals

-

Facing reputational and product-cycle challenges

The electric vehicle market hasn’t slowed — Tesla has.