CAM Report 2025: Electric Vehicle Market Surges 30% — China Dominates, Europe Accelerates, U.S. Falls Behind

Electric mobility is entering a new phase of global expansion.

According to the latest Electromobility Report by the Centre of Automotive Management (CAM), approximately 12.8 million battery-electric and plug-in hybrid vehicles were sold globally from January through September 2025 across the three most important automotive regions: China, Europe, and the United States.

This represents 30% year-over-year growth.

The balance of power, however, is shifting rapidly — and heavily in favor of Chinese manufacturers.

1. China: The Global Powerhouse of Electrification

China remains the undisputed engine of global EV growth.

-

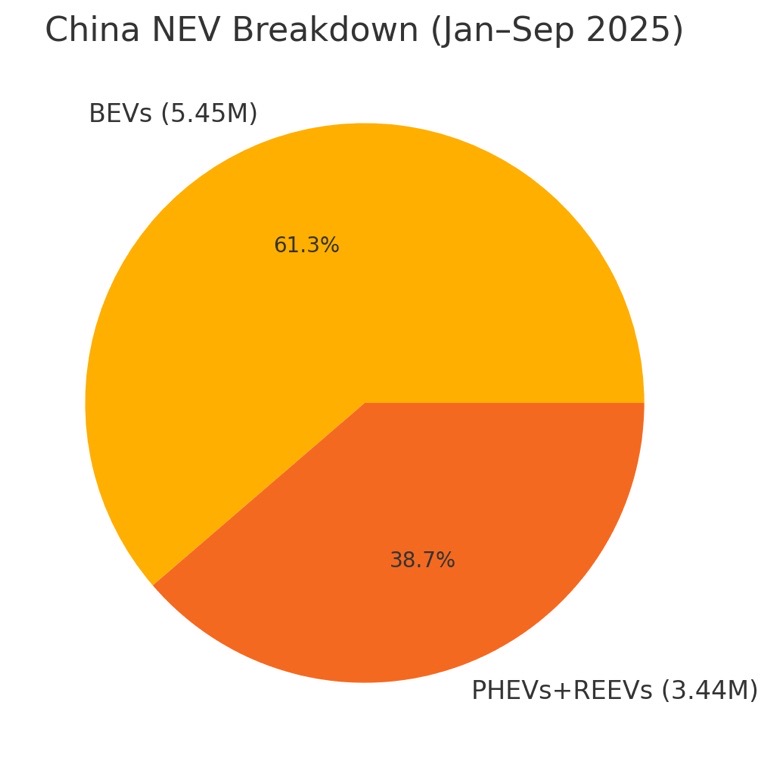

8.89 million NEVs sold (BEV + PHEV + REEV)

-

5.45 million BEVs

-

3.44 million PHEVs/REEVs

-

NEV market share: 52.4% (up from 45.3%)

-

BEV growth: +32%

-

PHEV growth: +14%

This shows clearly that pure electric vehicles now dominate the market, capturing more than 60% of China’s NEV sales.

Market Consolidation: 93 of 169 brands are disappearing

The report highlights a significant consolidation trend:

-

Top 10 brands = 70% of all NEV sales

-

BYD leads with 14.2% share

-

93 manufacturers have less than 0.1% share → functionally irrelevant

-

Volkswagen Group NEV sales fell 51.3% in China

-

BYD NEV share: 28.7%

-

Geely NEV share: 12.3%

-

VW: 0.9%

-

China is no longer a friendly market for Western automakers.

2. Europe: Strong Growth, But Uneven Across Regions

Despite a stagnating overall auto market, electrification in Europe is accelerating.

-

2.72 million EVs sold

-

+27.7% YoY growth

-

EV share: 27.4% of the total market

Chart 2 — EV Sales Growth in Europe (France, UK, Germany)

(Insert the second chart here)

Breakdown by major markets

🇫🇷 France

-

EV sales: 289,000 (–9%)

-

BEV volume steady at 216,000

-

Decline driven by tighter subsidy rules

🇬🇧 United Kingdom

-

EV sales up +32% → 522,000

-

BEVs: 349,414

-

Drivers: more models, lower prices, strong infrastructure policy

🇩🇪 Germany

-

Fastest-growing EV market in Europe

-

EV sales: 600,000 (+46.6%)

-

BEVs: 382,000

Europe is the world’s second-largest EV region, but with huge differences between Scandinavia, Western Europe, and Eastern Europe.

3. United States: The Slowest Growth Among Major Markets

The U.S. market is losing momentum:

-

1.22 million EVs/PHEVs sold (+8%)

-

Market share: 10%

-

BEV share: 8.2% (up slightly from 8.0%)

Reasons for slowdown:

-

EV tax credits expired on Oct 1

-

Brief September surge followed by expected Q4 collapse

-

Policy rollback under the Trump administration

-

High EV pricing and weaker domestic competition

The U.S. is rapidly falling behind China and Europe.

4. Global Automaker Rankings: China Takes Control

The global BEV market is shifting dramatically toward Chinese brands.

Top BEV Manufacturers (Jan–Sep 2025)

| Automaker | BEV Sales | Growth |

|---|---|---|

| BYD | 1.61M | +37% |

| Geely | 943k | +90% |

| Tesla | 1.22M | –5.9% |

| Volkswagen Group | 717,500 | +42% |

| BMW | 323,000 | +10% |

| Mercedes-Benz | 118,000 | –1% |

Key insights:

-

BYD is now the world’s largest EV manufacturer.

-

Geely is the fastest-growing major EV brand in the world.

-

Tesla is shrinking, losing nearly 6% YoY.

-

German brands show mixed performance — VW improving, Mercedes stagnating.

5. China’s NEV Market Share: Explosive Growth

China’s NEV market share grew from 45.3% to 52.4% in just one year — the fastest shift toward electrification in world history.

Conclusion: A New EV World Order

The CAM 2025 report makes one thing clear:

China leads. Europe follows. The U.S. falls behind.

-

China is the center of global EV production, sales, and technology

-

Europe is the second-largest and fastest-shifting region

-

U.S. EV adoption is stalling

-

Chinese automakers are becoming global powerhouses, overtaking Tesla and challenging European brands worldwide

2025 is shaping up to be a historic year for electric mobility, marking the beginning of a new global automotive structure.